[Asia Economy Reporter Park Jihwan] As the domestic REITs market enters a full-scale phase of large-scale growth, an analysis has emerged that the investment attractiveness is also rising.

Jang Moonjun, a researcher at KB Securities, stated, "Korean listed REITs have shown a pattern of price adjustment and sideways movement in the second half of the year following rapid price increases in the first half," adding, "However, Korean listed REITs remain highly attractive as income-type assets because they can consistently expect a dividend yield of around 4-6% based on stable cash flow." He assessed that the underlying Korean commercial real estate market is showing a solid performance, indicating high downside rigidity. The growth of the listed REITs market is expected to accelerate as the enlargement of existing listed REITs through the incorporation of new assets and the listing of new REITs coincide, which is also viewed positively.

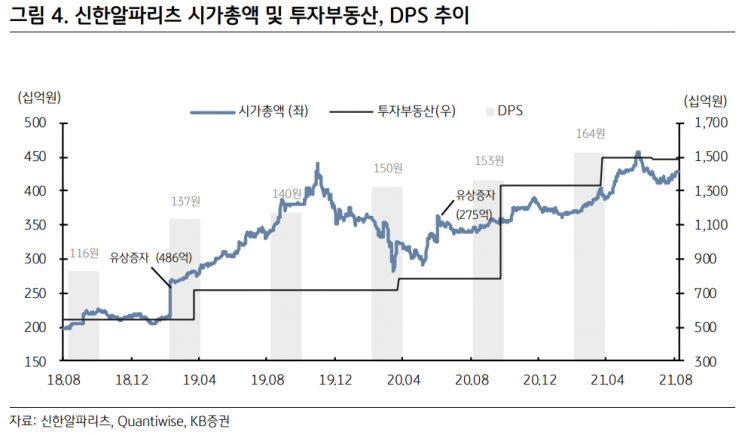

The first half of this year was seen as a period in which Korean listed REITs qualitatively advanced one step. Examples include Koramco Energy REIT, which sold assets based on the increased asset value of its held real estate, and cases such as ESR Kendall Square REIT, Shinhan Alpha REIT, Aegis Value REIT, and Aegis Residence REIT, which incorporated new assets solely through increased borrowings without separate capital increases, as well as IREIT KOREA, which lowered financing costs through refinancing. It was analyzed that it is significant to confirm that the AMC's management capabilities can increase the REIT's cash flow or asset value, ultimately benefiting shareholders.

Researcher Jang said, "The enlargement of REITs through the incorporation of new assets is important for both REITs and investors," adding, "Acquiring new assets allows diversification of the REIT's portfolio and prevents aging of held assets within the portfolio. Through economies of scale, it is possible to reduce financial costs, thereby strengthening profitability and increasing dividends."

Korean listed REITs are evaluated to be embarking on full-scale enlargement by acquiring new assets. For example, Shinhan Alpha REIT, which was listed in August 2018, increased the number of assets to six through two additional capital increases and loan increases utilizing the LTV ratio. He said, "As new assets continue to be incorporated, dividends per share are also increasing, demonstrating that the enlargement of REITs leads to shareholder benefits."

Researcher Jang emphasized, "Lotte REIT incorporated new assets through a capital increase at the beginning of the year, and many REITs are preparing to incorporate new assets," adding, "As Korean listed REITs are about to enter full-scale enlargement, continuous interest from investors is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)