Loan Inquiries Surge Amid NH Bank's Suspension of Mortgage Loans... "How Should We Handle Interim and Final Payments?"

[Asia Economy Reporter Park Sun-mi] "I need to take out a mortgage loan in October, but NH Nonghyup Bank, my main bank, is completely stopping new loans, so I am worried. I am also concerned that other banks might stop as well."

"The autumn moving season is just around the corner, but it feels like the ladder to owning a home has been kicked away. Is there anyone who can buy a house with 100% cash?"

As Nonghyup Bank decided to fully suspend new mortgage loans, real buyers on real estate online communities are pouring out their complaints, fearing funding problems ahead of the autumn moving season. Since the government and financial authorities are pressuring to strengthen household loan management, fear is spreading that other banks will soon take similar measures.

On the 20th, at Nonghyup Bank’s Yeouido branch, where many office workers gather, and other branches, inquiries about the suspension of mortgage loans flooded in immediately after business hours started at 9:30 a.m. Nonghyup Bank decided to suspend mortgage loans?including housing, non-residential land, and forest land?covering new loans, increases, and renewals from October 24 to November 30. Most people at branch counters asked until when they could apply for loans to receive them, and what documents and procedures they needed to prepare in advance. Some also asked whether group loans for interim payments on new apartments are included in the full suspension.

The situation was similar at other banks.

Rumors circulated mainly on online communities that loans from other banks would soon face difficulties, leading to a flood of inquiries about the possibility of loan suspensions. Especially among those planning funding ahead of the autumn moving season, anxiety is spreading that they need to secure funds early due to consecutive loan regulations such as the suspension of loans by commercial banks, the application of a 40% Debt Service Ratio (DSR), increases in mortgage loan variable interest rates, reduction of preferential interest rate margins, and cuts in credit loan limits.

A bank official said, "If loans are blocked at Nonghyup Bank, a ‘balloon effect’ will occur where customers flock to other commercial banks and secondary financial institutions, so the entire financial sector is closely watching the impact of this decision."

Financial Authorities Pressuring for Stronger Loan Management... Additional Loan Regulations Inevitable

Since Nonghyup Bank’s loan suspension was decided abruptly through internal discussions, financial authorities are also assessing the situation. At 11 a.m. on the same day, the Financial Services Commission convened a meeting with Nonghyup Bank and the Nonghyup Federation to exchange opinions on this loan suspension decision and household loan management plans.

Nonghyup Bank’s household loan growth rate from January to July this year was 7.1%, already exceeding the government’s annual target of 5-6%. Since the growth rate was significantly higher than other banks, it was necessary to receive plans on how to comply with the promised annual household loan target. Also, since Nonghyup Bank’s mortgage loan suspension is an extreme measure, discussions were needed to prevent market instability and adverse effects on real buyers.

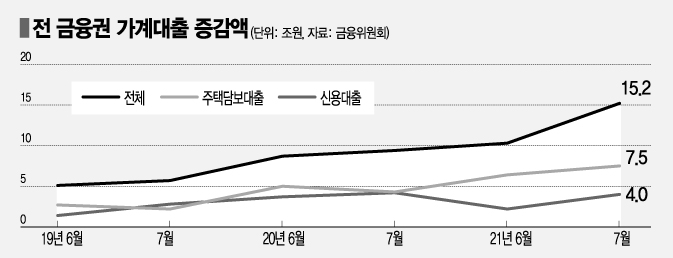

In the industry, the dominant view is that additional loan regulations are inevitable as financial authorities increase pressure on household debt management across all financial sectors, including banks. According to financial authorities, household loans across all financial sectors increased by 15.2 trillion won in July, up from 10.3 trillion won in the previous month. Mortgage loans surged by 7.5 trillion won in one month, increasing more than the previous month’s 6.4 trillion won. Net increases in other loans such as credit loans also rose from 3.9 trillion won in June to 7.7 trillion won in July.

Currently discussed measures include expanding the application of DSR regulations, reducing credit loan limits to ‘annual salary levels,’ expanding checks on mortgage loan contract violations, and loan recalls through these checks.

However, with the resurgence of COVID-19 and the U.S.’s early tapering (asset purchase reduction) moves increasing uncertainty about our economy, if household loans are suddenly blocked, it could cause side effects that block real buyers’ access to the housing market. Since many self-employed people use mortgage loans for living expenses or store operation costs, there are concerns that this could lead to increased livelihood burdens for ordinary people.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.