Service Access Blocked for Ages 14-19

Offline Counter Restrictions Also a Problem

[Asia Economy Reporter Kiho Sung] Starting January next year, the era of MyData (Personal Credit Information Management Service), which allows users to view their scattered financial information across various financial companies all at once, will be in full swing. However, concerns remain that accessibility among certain age groups is still low. In particular, since service use is blocked for adolescents, there are worries that not only will usage be inconvenient, but also financial literacy and economic education may become more difficult.

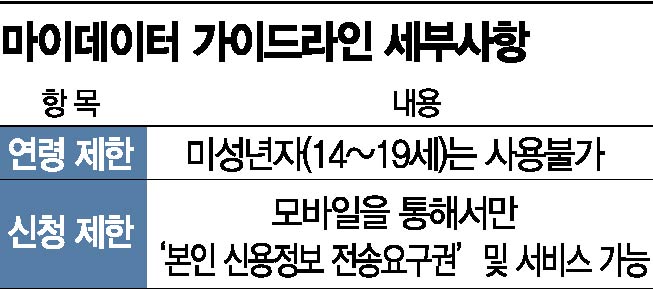

According to the financial sector on the 20th, the Financial Services Commission confirmed in the operational guidelines prepared ahead of the MyData implementation on the 29th of last month that service use is restricted for those aged 14 to 19. Adolescents in this age group can only request information transmission to themselves or institutions, but cannot exercise the right to request transmission as MyData users. Through MyData, customers can transmit their financial information excluding their own accounts, but this is excluded for adolescents.

The problem is that adolescents will no longer be able to use the services they have been using until now. Currently, adolescents can view and check financial information through a single application (app). However, according to the revised MyData service operational guidelines, adolescents will have to individually access information such as simple remittance history and payment history through multiple apps.

The industry has continuously expressed opinions that adolescents should also be included in the MyData service target, but financial authorities oppose this, stating that "excessive marketing competition may occur toward minors." However, there are concerns that service restrictions during adolescence, when financial habits are formed, could lower financial literacy as well as cause user inconvenience.

The controversy over reverse discrimination in MyData services is not limited to adolescents. Criticism has also been raised that accessibility for the financially vulnerable elderly is reduced because the service is not available at offline counters of banks and other financial institutions.

MyData service is executed through mobile by exercising the ‘right to request transmission of personal credit information,’ and the service can only be received on mobile devices. Elderly people who are vulnerable to mobile usage cannot exercise the right to request transmission of credit information even if they visit bank counters to apply for the MyData service.

Financial authorities are concerned that allowing the use of MyData services through offline counters of financial companies could lead to incomplete sales due to aggressive promotion by financial companies.

A financial sector official pointed out, "The elderly should receive the same benefits in line with the purpose of the MyData service," and added, "Since all processes at offline counters are thoroughly conducted under the current Financial Consumer Protection Act, concerns about incomplete sales are not high."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)