Synergy Expected When Yes24's Market Dominance Meets Naver's Logistics Capability

Also Effective in Checking Coupang's Entry into the Book Market

Bonus: Securing Stake in High-Growth Kakao Bank

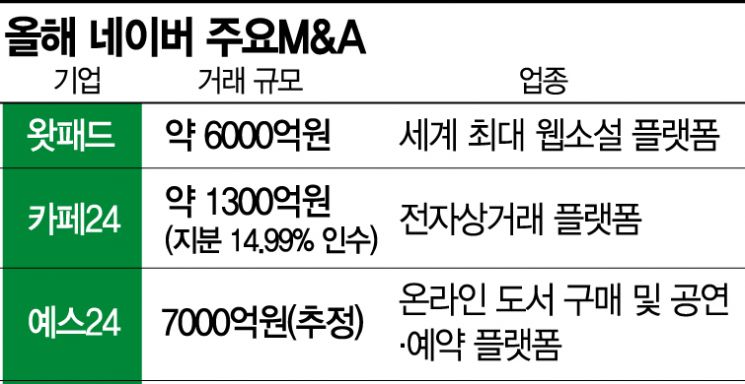

[Asia Economy Reporter Minwoo Lee] NAVER, which has been steadily engaging in mergers and acquisitions (M&A) this year with companies like Wattpad and Cafe24, has set Yes24 as its next target. If the acquisition of Yes24 is realized, it is expected to create a synergy effect by adding NAVER's logistics capabilities. NAVER could also quickly emerge as a strong player in the book and performance markets. Additionally, there is analysis suggesting that this move could help counter Coupang, which has already entered the book market leveraging its logistics strengths.

NAVER's acquisition of Yes24 is interpreted as a move to fully enter the book and performance markets. Yes24, which handles a wide range of cultural products including book and music distribution, as well as movie and performance ticket sales, ranked first among online bookstores with approximately 18.95 million cumulative members as of the first quarter of this year. It is reported that the website receives an average of 87,669 daily visitors. In the movie and performance ticket reservation market, Yes24 held the second-largest market share (26.93%) as of last year.

Unexpectedly benefiting from COVID-19, Yes24 has also recovered from its slump. In the first half of this year, sales reached 327.3 billion KRW and operating profit was 6.9 billion KRW, increasing by 9.4% and 20.3% respectively compared to the same period last year. Net profit also turned positive at 21.3 billion KRW, showing significant growth compared to the first half of last year. Jaeyoon Kim, a researcher at KTB Investment & Securities, explained, "After COVID-19, the shift of book purchasing demand from offline bookstores to online bookstores accelerated, making the top online bookstore the biggest beneficiary of this change."

If NAVER's capabilities are added to the logistics sector, which has been identified as an essential factor for Yes24's future growth, a further positive effect is expected. Originally, Yes24 planned to build a smart logistics center in the Paju area of Gyeonggi Province. Through this, they aimed to increase profitability by improving efficiency such as reducing labor costs and speeding up delivery processing in the online bookstore business, where cost control is key. If NAVER, which already has logistics capabilities, acquires Yes24, this issue will be resolved. For NAVER, which had not separately entered the book and performance markets until now, this is also an opportunity to rapidly increase market dominance.

There is also an interpretation that this move carries the meaning of countering Coupang, which is actively targeting the online bookstore market. Earlier, Coupang sent direct transaction business proposals to major publishers last year and expanded direct book purchases. Their strategy was to stock popular books from large publishers in Coupang's logistics warehouses to enable immediate delivery upon order. As a result, with famous bookstores like Songin Books and Seoul Bookstore going bankrupt one after another, there were forecasts that Coupang's market share in the publishing industry would increase even faster. An industry insider said, "If NAVER, which already has comprehensive logistics capabilities covering everything from ordering to delivery through various e-commerce channels, expands the influence of the Yes24 platform, it could put a brake on Coupang's strengthening dominance."

Securing shares in KakaoBank, which is highly valued for future growth potential, is also seen positively. Although KakaoBank's stock price has already risen to rank 9th in market capitalization on the domestic stock market (excluding preferred shares), considering platform dominance, its future value is expected to increase further.

However, the 'whims' of the Yes24 family could act as a variable. Earlier, in April, Yes24 distributed a Non-Disclosure Agreement (NDA) and Request for Proposal (RFP) for the sale of KakaoBank shares but withdrew the deal within a week. The letter of intent was canceled abruptly just three days after receipt. This was due to expectations that KakaoBank's value would continue to rise ahead of its IPO. At the time, the industry reacted with surprise. An industry insider revealed, "They did not provide an Information Memorandum (IM) and simply presented the volume and asked for payment plans, which seemed like a bidding competition where they said, 'Contact us if you want to buy.'"

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.