100% Surge in 354 Trading Days Since Last March's Lowest Point

Material-Related Companies Up 123%... IT and Financial Stocks Lead Bull Market

Analysis of Fed's Quantitative Easing Impact

Delta Variant and Economic Slowdown Risks... Tapering and Tax Hikes as Variables

Potential Correction Soon

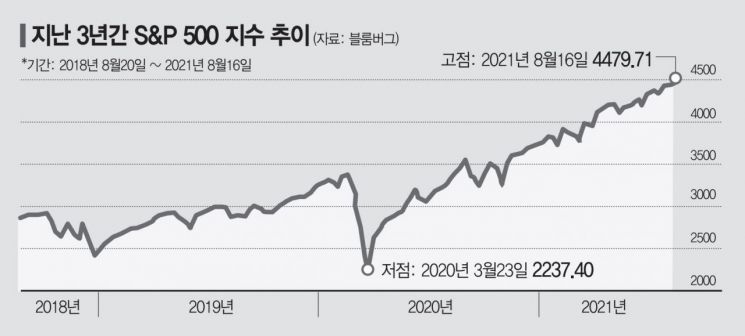

[Asia Economy Reporter Kim Suhwan] The U.S. New York stock market has recorded the strongest bull market since World War II. Major indices have doubled from their lowest points reached during the early stages of the COVID-19 pandemic last year in just over a year. Market experts are cautiously anticipating the possibility of a correction.

On the 16th (local time), the Dow Jones Industrial Average closed at 35,625.40, up 110.02 points (0.31%) from the previous session, while the Standard & Poor's (S&P) 500 index rose 11.71 points (0.26%) to close at 4,479.71. The tech-heavy Nasdaq index, however, fell 29.14 points (0.20%) to close at 14,793.76.

Notably, the S&P 500 index surged 100% in 354 trading days from its lowest point on March 23 last year, during the early phase of the COVID-19 pandemic, according to Bloomberg and CNBC.

The time it took for the index to double was the shortest since World War II. Ryan Detrick, an economist at LPL Financial, said, "It usually takes at least several years for a stock index to double," adding, "(The S&P 500's rise over the past year) is evidence that the New York stock market is experiencing an extraordinary bull market."

In particular, stocks of materials-related companies rose 123% from last year's lows, while information technology (IT) and financial stocks surged 120% and 118%, respectively, driving the S&P 500's gains.

The sustained bull market in New York is attributed to liquidity resulting from the Federal Reserve's quantitative easing policies.

Currently, the Fed maintains a 'zero interest rate' policy and purchases assets totaling $120 billion monthly, including $80 billion in U.S. Treasury securities and $40 billion in mortgage-backed securities (MBS).

Additionally, the strong earnings performance of major companies has also supported the bull market.

According to market research firm Refinitiv, operating profits of S&P 500 companies in the first quarter increased by 53% year-on-year, and a growth rate of 93.8% is expected for the second quarter.

However, concerns have been raised that the spread of the Delta variant and the resulting slowdown in economic recovery could pose risks. Chris Larkin of E*TRADE Financial said, "We cannot deny concerns that the Delta variant, weak growth in other countries, and the Afghanistan situation are scaring investors."

Moreover, there are assessments that the upward momentum of the New York stock market has significantly weakened. Bloomberg pointed out that the S&P 500's gains in August were the lowest so far this year.

The weakening momentum is due to the fact that major indices, including the S&P 500, have already reached record highs, increasing the likelihood of a correction.

Economist Detrick emphasized, "There has been no significant correction since October last year," adding, "We need to prepare for the possibility of a correction soon."

Turbius Levkovich, head of U.S. equity investments at Citigroup, said, "Investors need to prepare for variables such as tapering, potential tax increases, and persistent inflation," adding, "We need to be more cautious. These variables could emerge around September."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.