Number of Employees per Store 17.8 in Q1 This Year, Increasing for 4 Consecutive Years

Store Consolidation Leads to Higher Staff per Store

Accelerating 'Digital Diet' to Compete with Big Tech

[Asia Economy reporters Kiho Sung and Seungseop Song] Amid the acceleration of non-face-to-face financial transactions due to the emergence of internet-only banks and COVID-19, the number of employees per branch at domestic banks has increased by about two compared to four years ago. Despite large-scale branch and workforce restructuring to counter the fierce offensive from big tech (large information and communication companies) and fintech (finance + technology) such as Naver, Kakao, and Toss, the high-cost, low-efficiency structure has deepened.

The banking sector’s concerns seem to be growing deeper as they undertake abnormal workforce restructuring for financial digitalization and virtuous cycle improvements, incurring huge voluntary retirement costs every year.

Where Did the Disappeared Branch Employees Go?

According to the Bank of Korea’s Economic Statistics System on the 10th, the number of domestic bank branches (including specialized banks) in the first quarter of this year was 6,558, down 269 from 6,827 last year. During the same period, the number of employees decreased by 2,254 from 119,040 to 116,786.

The reason banks are accelerating branch and workforce reductions is interpreted as a strategy to improve operational efficiency and profitability, as the number of financial consumers visiting branches has significantly decreased since the COVID-19 outbreak. Especially, digital transformation is essential to compete with big tech, but the fixed costs of tens of billions of won annually per branch are a burden on banks.

Despite large-scale downsizing, the number of employees per branch has increased?from 15.7 in 2018 to 17.8 in the first quarter of this year. This means branch efficiency has actually declined. The number of employees per branch has been on the rise for four consecutive years.

The banking sector explains that due to branch consolidations and closures, the number of employees has not decreased in proportion to the number of branches. A banking official said, "When a bank branch closes, it does not mean that all employees working there quit," adding, "Employees from closed branches are often integrated into nearby branches."

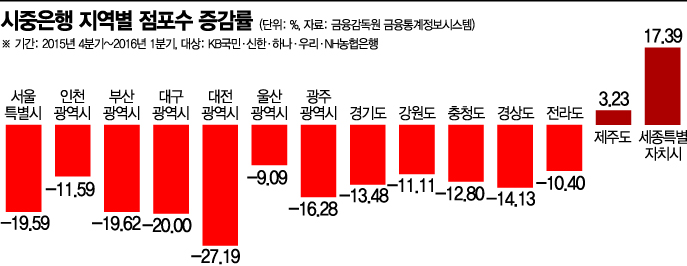

In fact, branch reductions are mainly taking place in the metropolitan area and large cities where consolidation and closures are easier. According to the Financial Supervisory Service, the number of branches nationwide by region for KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup Banks decreased by 16.18% from the end of 2015 to March this year. Daejeon had the highest decrease rate at -27.19%, followed by Daegu (-20%), Busan (-19.62%), and Seoul (-19.59%).

Professor Daejong Kim of the Department of Business Administration at Sejong University diagnosed that branch and workforce reductions are an inevitable choice for competitiveness. Professor Kim explained, "For companies, profit is the most important, and with huge fixed costs and rent, the environment itself has changed to non-face-to-face finance," adding, "Since Kakao Bank and Toss are making waves in the industry without branches, commercial banks have accelerated a kind of branch restructuring."

Saving 250 Billion Won by Branch Reduction, Pouring 1 Trillion Won into Voluntary Retirement

Banks say it is efficient to boldly close loss-making branches and concentrate manpower on profitable branches. It is known that the labor and rent costs to operate one branch in a large city average between 1.2 billion and 1.7 billion won. To maintain profitability, each branch must secure deposits and loans worth about 200 billion won. Loss-making branches that cannot meet this are emerging one after another.

Moreover, as the era of obtaining loans through mobile applications (apps) has arrived, building digital transformation is essential to survive in the competitive market.

In fact, as non-face-to-face finance has become active, internet-only banks are launching fierce attacks. Kakao Bank’s average pre-provision operating profit per employee in the first quarter of this year was 75 million won. The pre-provision operating profit, which indicates the productivity per employee at financial companies, is calculated by dividing the bank’s total operating profit minus selling and administrative expenses by the average number of domestic employees. It is not affected by changes in provisions or asset size, thus showing the operational competitiveness of individual banks.

The five major banks recorded an average pre-provision operating profit per employee of 58.6 million won in the first quarter. The highest was KB Kookmin Bank at 62 million won. Although it is the top commercial bank, it is 13 million won lower than Kakao Bank. The lowest was up to 20 million won behind Kakao Bank. This is the first time all five major banks have been outperformed by Kakao Bank, which has only one branch, in productivity indicators.

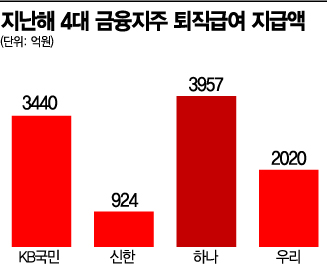

Although branch closures and workforce reductions, which incur high fixed costs, are necessary to increase productivity, the situation is still distant. Last year, commercial banks are estimated to have saved about 25 billion won through branch closures. On the other hand, the four major financial holding companies spent 1.0341 trillion won on severance pay for voluntary retirement last year, a 10.6% increase from 934.6 billion won the previous year.

However, some express concerns that rapid branch reductions by banks are harming vulnerable groups. There are also criticisms that this does not meet the government’s emphasis on job creation. Jo Yeonhaeng, chairman of the Financial Consumer Federation, said, "I understand banks pursuing profitability, but it is also true that vulnerable groups suffer inconvenience and damage during branch reductions," adding, "Banks also have public responsibilities, but the current pace of branch reduction is too steep."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)