[Asia Economy Reporter Minji Lee] Mirae Asset Global Investments' 'TIGER ETF' has surpassed a 30% market share in the domestic market.

According to the Korea Exchange on the 6th, as of the previous day's closing price, the total net assets of all ETFs amounted to KRW 61.5041 trillion, of which TIGER ETF accounted for KRW 18.4704 trillion, approaching a market share of 30.03%.

This is the result of Mirae Asset leading the market with thematic ETFs, increasing its market share by about 5% in 2021. The combined net assets of the eight new listings by Mirae Asset this year, including the 'TIGER U.S. Philadelphia Semiconductor Nasdaq ETF,' exceed KRW 1 trillion.

More than half of the increase in the domestic ETF market compared to the end of last year, KRW 5.3018 trillion, flowed into TIGER ETFs. The TIGER China Electric Vehicle SOLACTIVE ETF was the top ETF in net purchases by individual investors this year, with individual investors net buying over KRW 740 billion.

Mirae Asset introduced thematic ETFs to a market dominated by representative index ETFs, inverse, and leveraged ETFs, providing investors with diverse investment options. In 2018, they listed the 'TIGER TOP10 ETF,' which invests in the top 10 Korean market capitalization stocks, and the 'TIGER 2nd Battery Theme ETF,' which invests in secondary battery companies. In 2019, they led the market with thematic products by listing five 'TIGER KRX BBIG K-New Deal ETF' series that invest in themes such as secondary batteries, bio, internet, and gaming.

They also introduced products verified overseas through their global network to Korea. Especially, the overseas stock ETFs listed by Mirae Asset are popular in long-term pension accounts, focusing on growth themes. The 'TIGER China Electric Vehicle SOLACTIVE ETF,' listed in December last year, was the first overseas stock ETF listed domestically to surpass KRW 1 trillion in net assets. This ETF tracks the same index as the 'Global X China Electric Vehicle and Battery ETF,' which was listed in Hong Kong in January. The 'TIGER Global Lithium & 2nd Battery SOLACTIVE ETF,' launched in July, follows the same management strategy as the 'Lithium & Battery Tech ETF' listed on the U.S. Nasdaq and surpassed KRW 100 billion in net assets just four days after listing.

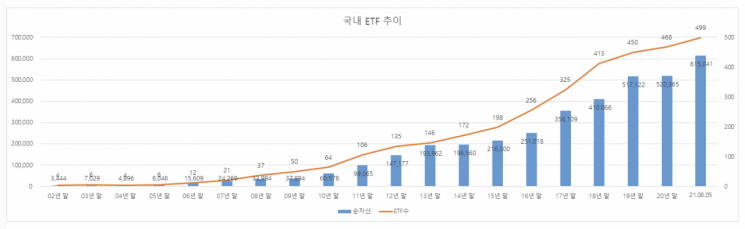

The domestic ETF market started in 2002 with 4 products and net assets of KRW 344.4 billion, and has now grown into the 11th largest market worldwide with 499 products and over KRW 61 trillion. Mirae Asset Global Investments entered the ETF market in 2006 and led the market by introducing new ETFs, including the industry's first advanced country ETF, 'TIGER U.S. Nasdaq 100 ETF' in 2010, and the thematic ETF 'TIGER China Consumption Theme ETF' in 2011. Mirae Asset's TIGER ETF has grown from 37 products and KRW 1.4366 trillion in net assets at the end of 2011 to 128 products and KRW 18.4704 trillion, increasing the number of products by 3.5 times and net assets by 12.9 times. Its market share has also more than doubled from 14.5%.

Choi Kyung-joo, Vice Chairman of Mirae Asset Global Investments, said, "Mirae Asset is a global investment specialist group dedicated to the successful asset management and peaceful retirement of our clients," adding, "We will continue to supply competitive thematic products that clients can invest in mid- to long-term by leveraging Mirae Asset's global network."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)