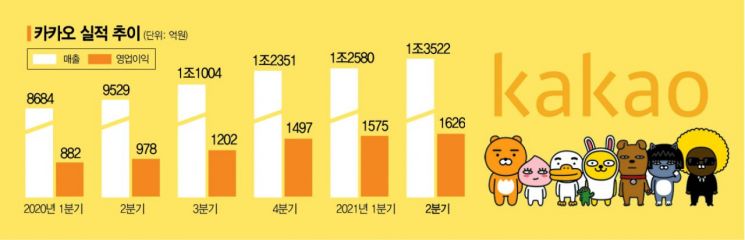

Kakao's rapid growth continues. Kakao recorded another all-time high performance in the second quarter of this year. Revenue hit a record high for 17 consecutive quarters, and operating profit reached a record high for 10 consecutive quarters. Notably, remarkable achievements were made not only in core businesses such as platforms and content but also in new ventures like Kakao Mobility.

Record High Advertising Revenue... Wings for Commerce, Mobility, and Content

Kakao announced on the 6th that its second-quarter revenue reached KRW 1.3522 trillion, and operating profit was KRW 162.6 billion. These figures represent increases of 42% and 66%, respectively, compared to the same period last year.

Kakao's strong performance was driven by the expansion of advertising and commerce businesses based on KakaoTalk, new business sectors, and the content business. Kakao's revenue is divided into two categories: the 'Platform segment' and the 'Content segment.' Platform segment revenue was recorded at KRW 761.8 billion, a 47% increase compared to the same period last year. Talk Biz revenue, which includes KakaoTalk advertising and commerce, reached KRW 390.5 billion, up 52%. Advertising revenue hit an all-time high due to growth in Biz Board and KakaoTalk Channel. Portal Biz revenue increased by 7% to KRW 125.1 billion.

Other segment revenue showed strong growth, reaching KRW 246.2 billion, up 73% from the same period last year, driven by increased demand for premium taxis from Kakao Mobility and expanded payment transaction volume via Kakao Pay. The number of completed premium taxi rides tripled, and the number of franchise taxis under 'KakaoT Blue' expanded to 26,000 vehicles. Kakao Mobility is also preparing to launch new services such as rental cars and shared electric scooters in the second half of the year.

The growth of the content business, including webtoons and games, also contributed to improved performance. Content segment revenue was KRW 590.4 billion, a 35% increase compared to the same period last year. Story revenue reached KRW 186.4 billion, a 57% growth, driven by Kakao Japan's webtoon platform 'Piccoma,' which ranked first in manga app revenue, and increased global intellectual property (IP) distribution transaction volume by Kakao Entertainment. Notably, Piccoma surpassed a daily maximum transaction volume of KRW 4.5 billion in early May, and its second-quarter transaction volume doubled year-on-year to KRW 174 billion. Kakao has set a target of KRW 1 trillion transaction volume for Kakao Japan this year.

Music revenue increased by 11% year-on-year to KRW 188.1 billion. Media revenue (original content, dramas, movies, entertainment) grew 112% to KRW 87.4 billion, thanks to the popularity of Kakao Entertainment's content. Game revenue rose 20% year-on-year to KRW 128.6 billion.

Consolidating Core Businesses... Growth through Subscription Economy

Kakao is strengthening its commerce and content businesses, which have been major contributors, while also focusing on new growth engines.

First, it absorbed its subsidiary Kakao Commerce to reinforce its shopping business. Kakao explained, "The platformization of commerce is accelerating, and meaningful services and growth will emerge." Following the merger of webtoon subsidiary Kakao Page and entertainment subsidiary Kakao M to launch Kakao Entertainment, it also absorbed Melon Company, becoming a 'content giant.'

In particular, Kakao Webtoon plans to expand its global business centered on Japan, Southeast Asia, and North America. Bae Jae-hyun, Senior Vice President of Kakao, said regarding North American webtoon platform Tapas and web novel platform Radish, "From the third quarter, they will be included in Kakao Entertainment's global platform network, and we plan to actively expand our North American business," adding, "We expect to become a completely new global content company within three years."

Additionally, Kakao announced that the number of subscribers to KakaoTalk Wallet, which stores certificates and digital IDs, has surpassed 18 million, with a goal of reaching 25 million subscribers by the end of the year.

Kakao also plans to establish new growth engines through the subscription economy. Centered on the newly launched subscription platform 'View,' it aims to create a 'lock-in effect' by binding users through subscription economy. With the launch of View, the overall Kakao subscription platform framework was completed, including regular subscription services like 'Subscription ON' and digital item subscriptions such as Emoticon Plus and Talk Drawer Plus. A paid subscription model will also be introduced in 'View.'

Yeo Min-soo, Co-CEO of Kakao, emphasized, "With the core axis of subscription established from products and services to content, the subscription ecosystem that Kakao will develop will rapidly expand centered on KakaoTalk Channel," adding, "As user engagement and traffic continue to increase, growth momentum for advertising, commerce, and Talk Biz will be created." However, Kakao added that it has no plans to introduce a 'membership' service that accumulates a portion of shopping amounts like Naver or Coupang.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.