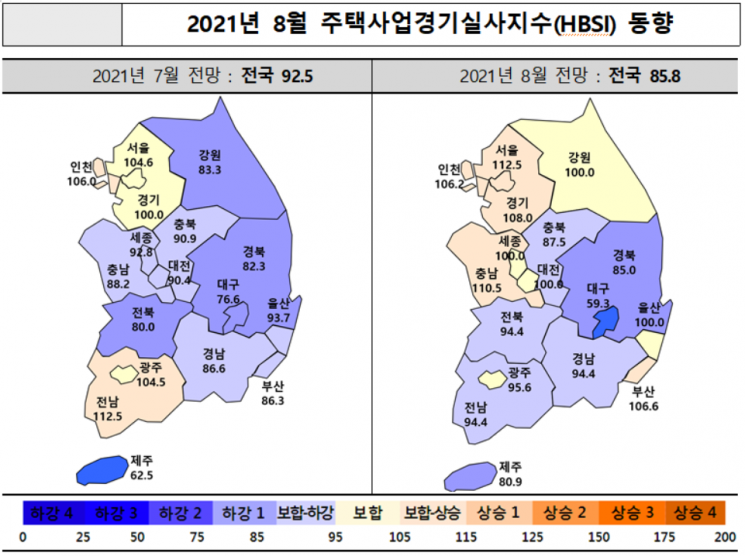

[Asia Economy Reporter Ryu Taemin] The nationwide housing business outlook for August appears to have declined for the second consecutive month. While the outlook is positive in Seoul and other metropolitan areas, some provinces are expected to face unfavorable housing business conditions, showing regional disparities.

On the 5th, the Korea Research Institute for Human Settlements (KRHS) announced that the Housing Business Survey Index (HBSI) forecast for August nationwide dropped 6.7 points from the previous month to 85.8. Although the nationwide HBSI showed an upward trend and strong performance in the first half of this year, it fell 20.5 points compared to the previous month and has been declining for two consecutive months. The HBSI, surveyed among housing developers, is an indicator forecasting the housing business market from the supplier's perspective. A value above 100 indicates a positive outlook on the housing market.

By region, Seoul’s August HBSI forecast rose 7.9 points from the previous month to 112.5, surpassing the 110 mark again. This is attributed to the government's selection of leading urban housing supply projects such as public redevelopment projects and small-scale reconstruction projects. Additionally, with Seoul City's policy stance on normalizing redevelopment regulations maintained, expectations for improved housing business conditions centered on redevelopment projects seem to be sustained.

Positive outlooks on housing business conditions are also recovering mainly in provincial metropolitan cities. Busan’s HBSI rose 20.3 points from the previous month to 106.6, increasing optimism about housing business. Other cities such as Daejeon (100.0) and Ulsan (100.0) also exceeded the baseline of 100.

However, some provinces showed a significant drop in the August HBSI forecast, with a prevailing expectation of a contraction in the housing business market. In particular, Daegu fell 17.3 points from the previous month to 59.3, expanding negative perceptions about housing business. Other regions including Chungbuk (87.5), Gyeongbuk (85.0), and Jeju (80.9) also recorded below the baseline of 100.

Material shortages continue to adversely affect the construction market. The August forecasts for financing and material supply were 89.2 and 73.4, respectively. Although the material supply forecast slightly increased from the previous month, the financing forecast declined and remained below 100, indicating a predominantly negative outlook.

KRHS advised, “In a situation where housing business outlooks vary by region, it is necessary to prepare housing business strategies considering regional conditions.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)