About 4 Trillion Won Invested in the First Half... Semiconductor Equipment Deployment Accelerates

Only Overseas NAND Flash Factory... Considering Investment Expansion Amid Market Improvement

[Asia Economy Reporter Jeong Hyunjin] Samsung Electronics' expansion of its Xi'an semiconductor fab 2 in China is progressing smoothly toward the goal of starting operations within this year. Ahead of full-scale production this year, the company has made large-scale equipment investments, with over 4 trillion KRW invested in the first half alone. With expectations of an improved NAND flash market in the second half, Samsung Electronics is accelerating capacity expansion through investment execution exceeding the original plan.

According to industry sources and foreign media on the 4th, the Shanxi Provincial Development and Reform Commission reported that Samsung Electronics invested 23 billion yuan (approximately 4.09 trillion KRW) in the expansion of the Xi'an semiconductor fab 2 in the first half of this year. This amount corresponds to 108.5% of the annual investment plan disclosed to local authorities by Samsung, indicating an investment about 2 billion yuan higher than planned.

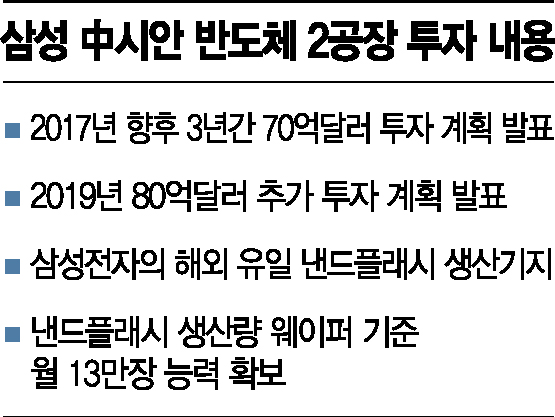

The Xi'an semiconductor fab is Samsung Electronics' only overseas NAND flash production base. To respond to the increasing global memory semiconductor market demand, Samsung decided to expand the Xi'an semiconductor fab 2 starting in 2017 and has continued investments aiming for full operation this year. Following the announcement of a 7 billion USD (approximately 8 trillion KRW) investment in 2017, Samsung declared an additional 8 billion USD investment in December 2019.

The concentration of investment in this fab during the first half of this year appears to be due to the full-scale deployment of semiconductor equipment. In March, local reports indicated that Samsung had begun equipment installation for the operation of the Xi'an semiconductor fab 2.

Samsung Electronics is reportedly considering expanding its investment in the Xi'an semiconductor fab beyond the originally planned amount, anticipating an improvement in the NAND flash market. In a recent Q2 earnings conference call, Samsung projected an annual NAND flash demand bit growth (increase rate in shipment volume by bits) in the 40% range, which is expected to surpass DRAM's bit growth in the mid-20% range. Internally, Samsung is said to be contemplating increasing investment from the initially planned 15 billion USD to around 20 billion USD.

Once the expansion of Samsung's Xi'an semiconductor fab 2 is completed within this year, the fab's NAND flash production capacity is expected to reach 130,000 wafers per month. Combined with the capacity of fab 1, the Xi'an site in China will be capable of producing about 250,000 wafers of NAND flash monthly. Samsung Electronics currently holds a dominant 33% market share in the NAND flash market.

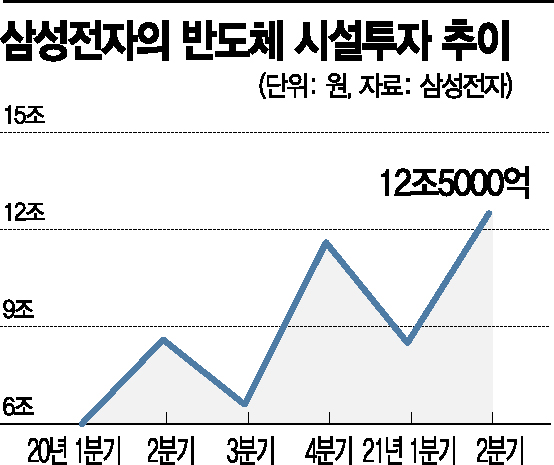

Samsung Electronics invested 23.3 trillion KRW in domestic and overseas facilities in the first half of this year alone. Notably, the Q2 facility investment amounted to 13.6 trillion KRW, surpassing the 13 trillion KRW recorded in Q4 last year, marking a quarterly record high. Semiconductor facility investment also reached an all-time high in Q2. A Samsung Electronics official stated, "In Q2 this year, investments in memory were made to respond to future demand increases, focusing on expansions and process transitions in Pyeongtaek and Xi'an, China."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)