Introduction of New Collection Methods Reflecting Era Changes: House Searches, Movable Property Seizure, Internet Domain and Cryptocurrency Seizure

Nationwide First Dedicated Organization Launched in 2001, Upgraded to 'Department' Level in 2008, Growing into the Largest Organization in Local Governments

Strong Collection for Malicious High-Amount Defaulters... Active Support for Recovery through Credit Rehabilitation and Welfare Linkage for Livelihood Defaulters

[Asia Economy Reporter Lim Cheol-young] The Seoul Metropolitan Government's '38 Tax Collection Division,' established in 2001 with the goal of "pursuing until the end to ensure collection," has marked its 20th anniversary. Over the years, the 38 Tax Collection Division has collected delinquent taxes amounting to 3.6 trillion KRW, growing into the largest specialized delinquent tax collection organization among local governments. In particular, by seizing internet domains, court deposits, and bank safe deposit boxes to enhance collection effectiveness, and for the first time this year, implementing seizure measures on virtual currencies and seizing assets from high-value delinquent taxpayers who concealed assets by exchanging cash for cashier's checks, the division continues its strong delinquent tax collection activities.

According to the Seoul Metropolitan Government on the 4th, over the past 20 years, the city has collected a total of 3.6 trillion KRW in delinquent taxes from 47.45 million cases centered on the 38 Tax Collection Division. This averages to about 178.6 billion KRW collected annually. As of the end of July this year, 182.6 billion KRW has been collected, which is 92% of the annual collection target (201 billion KRW), indicating an early achievement of the goal.

When the 38 Tax Collection Division was launched in August 2001, it consisted of 2 teams with 25 members. During Mayor Oh Se-hoon's term in 2008, it was promoted to a 'division' level organization and currently operates with 5 teams comprising 31 specialized investigators and 6 private debt collection experts. Other local governments, including the National Tax Service and Gyeonggi Province, have also benchmarked Seoul and established dedicated organizations.

Lee Byung-wook, head of the 38 Tax Collection Division, explained, "Over the past 20 years, Seoul has expanded the organization and developed and introduced new delinquent tax collection methods in line with changing times, persistently pursuing and collecting from malicious high-value delinquent taxpayers while supporting livelihood-type delinquent taxpayers to recover and become compliant taxpayers again, thus advancing delinquent tax collection activities."

The 38 Tax Collection Division has played a leading role in pioneering numerous new collection methods and guiding other agencies' delinquent tax collection efforts. The seizure of movable property through home searches was first attempted and established by the 38 Tax Collection Division. Beyond movable property, the division has identified and seized other valuable assets to increase collection effectiveness. Internet domains, court deposits, bank safe deposit boxes, and the seizure of garden trees and ornamental stones were all first attempted by the 38 Tax Collection Division. This year, it became the first local government to implement seizure measures on virtual currencies and also carried out seizures on high-value delinquent taxpayers who concealed assets by exchanging cash for cashier's checks. The division has also actively begun seizing intangible property rights such as copyrights and patents.

For livelihood-type delinquent taxpayers facing economic difficulties, the 38 Tax Collection Division supports credit recovery to help them become compliant taxpayers again and actively links welfare services. This year, due to the prolonged COVID-19 pandemic, the wage garnishment threshold was expanded to 2.24 million KRW, applying the Seoul-type living wage standard for delinquent taxpayers struggling to make a living. Through outreach counseling, suspension of delinquent disposition and administrative sanctions, and welfare support linkage, the division helps facilitate a quick return to daily life.

The Seoul Metropolitan Government stated that it will continue to focus on collecting without exception from unscrupulous high-value delinquent taxpayers and socially prominent individuals, while actively supporting recovery for delinquent taxpayers facing hardship. For small business owners, self-employed individuals, and livelihood-type delinquent taxpayers, the government will actively defer or lift credit delinquency registrations to support economic recovery, and will conduct in-depth investigations into delinquent amounts of vulnerable groups such as homeless people and basic livelihood security recipients. If collection is impossible, it will issue loss dispositions and assist in their rehabilitation.

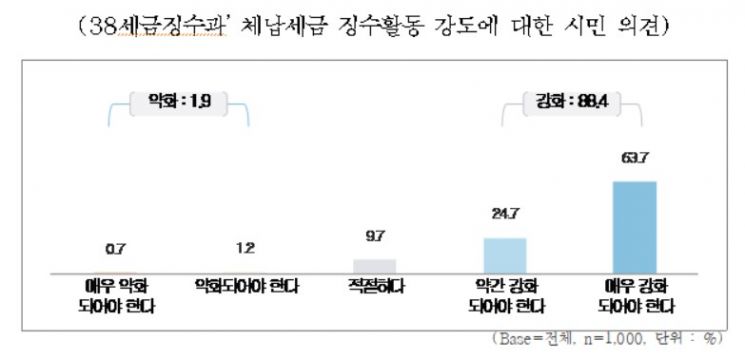

Meanwhile, Seoul citizens acknowledged that the 38 Tax Collection Division's delinquent tax collection activities contribute to fostering a culture of sincere tax payment but also evaluated that stronger collection efforts are necessary.

According to an online survey conducted by the Seoul Metropolitan Government targeting 1,000 citizens on the 20th anniversary of the 38 Tax Collection Division, 88.2% agreed that harsher penalties are needed for unscrupulous high-value delinquent taxpayers. In particular, 88.4% across all age groups responded that the intensity of the 38 Tax Collection Division's delinquent tax collection activities should be 'strengthened' beyond the current level.

Lee Byung-han, Director of the Seoul Metropolitan Government's Finance Bureau, said, "Over the past 20 years, we have achieved remarkable results by establishing seizure activities through home searches and introducing numerous new collection methods, but we also confirmed that citizens still desire stronger delinquent tax collection activities. We will pursue the assets of unscrupulous high-value delinquent taxpayers to the end in line with citizens' expectations and ensure collection to realize tax justice and spread a culture of sincere tax payment."

Mayor Oh Se-hoon urged, "The 38 Tax Collection Division is a modern-day secret royal inspector. Please continue to demonstrate that tax justice in Seoul and the Republic of Korea is alive through thorough collection from malicious and unscrupulous delinquent taxpayers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)