[Asia Economy Reporter Su-yeon Woo] As the era of carbon neutrality approaches and countries around the world increase investments in renewable energy facilities, there is a claim that expanding supply chains and pioneering new markets and businesses are necessary to strengthen the competitiveness of South Korea's solar power industry.

According to the report "Global Solar Market Trends and Strategies for Korean Companies' Entry," released on the 5th by the Korea International Trade Association's International Trade and Commerce Research Institute, solar power accounted for more than half, 54%, of the global new renewable energy facilities in 2020. In terms of investment scale, solar power accounted for $126.5 billion, or 44.8%, of global renewable energy investments.

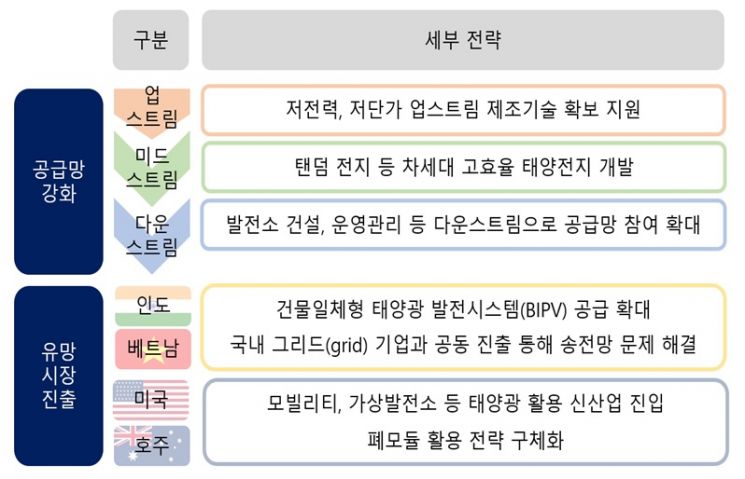

The solar power supply chain is broadly divided into upstream, midstream, and downstream. Upstream includes materials and raw material supplies such as polysilicon, ingots, and wafers, which are close to raw material supply. Downstream consists of the solar power plant installation, construction, and maintenance market. Midstream is represented by solar cells and solar modules.

Most of South Korea's solar power industry is concentrated in the midstream sector. Last year, South Korea's solar product exports amounted to $1.51349 billion, with 91.3% accounted for by the midstream sector's cells and modules. Until 2017, the upstream sector accounted for 38.4%, but due to strong price competition from Chinese companies, it sharply declined to 8.7% last year.

The report emphasized, "It is necessary to expand the participation of Korean companies in the solar power supply chain, which is concentrated on cells and modules," adding, "In particular, the downstream sector, including solar power plant maintenance, is a business area where Korean companies with Internet of Things (IoT) technology strengths have advantages and is expected to be highly profitable in the long term, requiring interest and investment."

Promising markets for solar power entry include India, Vietnam, the United States, and Australia. India is expected to account for more than 10% of global solar power generation within the next five years, and Vietnam has emerged as the center of the ASEAN solar market thanks to the Feed-in Tariff (FIT) system. The United States and Australia have high demand for residential solar cells and modules, which are major export items of Korea.

The report advised, "Since the transmission network capacity in India and Vietnam does not meet solar power generation, it is effective to enter jointly with domestic grid companies, and as urbanization rates are rapidly rising, the supply of Building-Integrated Photovoltaics (BIPV) should be expanded," adding, "In mature solar markets such as the United States and Australia, entering new solar-related businesses such as mobility and virtual power plants and strategies for recycling used modules are important."

Jo Eui-yoon, senior researcher at the Korea International Trade Association, said, "Chinese companies that have succeeded in cost reduction are leading the global solar industry, but the entry potential of our companies can gradually expand, especially in countries like the United States and India that have conflicts with China," adding, "As discussions on carbon border taxes become more active, the solar market will grow faster than now, and efforts should also be made to improve technology, such as developing next-generation high-efficiency cells."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.