Landlord-affiliated Savings Banks' H1 Net Profit Rises 15.3% to 55.7 Billion KRW

Financial Authorities: "Managing Expansion via Regulatory Arbitrage Between Banks and Non-Banks"

Industry: "Must Comply with Authorities' Orders... Growth Difficult in H2"

[Asia Economy Reporter Song Seung-seop] Savings banks under financial holding companies seem unable to smile despite favorable first-half performance. This is because financial authorities have announced regulations on household loans in the savings bank sector. If regulatory arbitrage disappears and linked loans with affiliated commercial banks become difficult, it is expected to inevitably impact the profit structure.

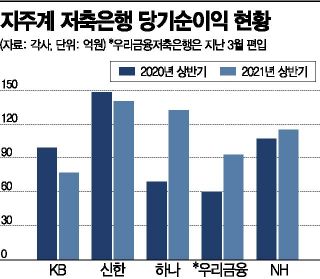

According to the financial industry on the 2nd, the net profit of savings banks owned by the five major financial holding companies?KB, Shinhan, Hana, Woori, and NH?reached 55.7 billion KRW in the first half of this year. This is a 15.3% (7.4 billion KRW) increase from 48.3 billion KRW in the same period last year.

Hana Savings Bank's net profit during this period increased by 91.3% (6.3 billion KRW) to 13.2 billion KRW, thanks to actively expanding corporate customer loans in the first half. Woori Financial Savings Bank, incorporated in March, also saw its net profit rise 55% (3.3 billion KRW) from 6 billion KRW to 9.3 billion KRW. NH Savings Bank slightly increased from 10.7 billion KRW to 11.5 billion KRW.

KB Savings Bank and Shinhan Savings Bank saw their net profits decrease by 22.2% and 5.4% to 7.7 billion KRW and 14 billion KRW, respectively, but other indicators were generally favorable. KB Savings Bank's total assets increased by 7.958 trillion KRW (51.3%) to 23.458 trillion KRW from 15.5 trillion KRW in the first half of last year. Shinhan Savings Bank's assets also grew by 25.5% (4.713 trillion KRW) to 23.135 trillion KRW. Return on assets (ROA) and return on equity (ROE) also improved.

Nevertheless, the outlook for the second half is bleak according to industry insiders. Financial authorities plan to strongly curb the increase in household loans in the secondary financial sector, focusing on savings banks. The Financial Supervisory Service already recommended at the end of May that the savings bank sector limit household loan growth to 21.1%, the same level as last year. Recently, they have demanded submission of statistics including new loan disbursement amounts and counts, the proportion of high-income credit loans, and the proportion of high DSR loans. It is inevitable that active linked loan sales like before will face obstacles.

Industry: "Must comply with authorities' regulations... Growth as strong as first half will be difficult"

In particular, financial authorities have consistently pointed out the regulatory arbitrage of savings banks. Currently, commercial banks have a strengthened regulation limiting the Debt Service Ratio (DSR) to 40%, while savings banks still have a 60% limit. If additional funds are needed after taking out a mortgage loan from a commercial bank, one can borrow more from a savings bank. Savings banks under financial holding companies have used this to recruit borrowers through linked loans with affiliated commercial banks.

However, financial authorities perceive this sales method as a side effect of the "balloon effect." On the 28th of last month, Eun Sung-soo, Chairman of the Financial Services Commission, stated, "There are concerns about the expansion of loans in the secondary financial sector exploiting differences in regulations between financial sectors," and added, "We will regularly monitor and respond to prevent market distortion caused by regulatory arbitrage." Do Gyu-sang, Vice Chairman of the Financial Services Commission, also warned on the 15th of last month at the Household Debt Risk Management Task Force (TF) that "We are closely watching behaviors that attempt to expand scale by exploiting regulatory arbitrage between banks and non-banks."

Savings banks under financial holding companies are considering ways to operate in the second half. Some companies secured funds worth 70 to 100 billion KRW through rights offerings one to two months ago, but they now need to find new loan sources for operations.

Internally, plans to expand corporate credit or mid-interest loans are being discussed, but the situation is not favorable. Although financial authorities have stated there are no immediate plans to unify the DSR level, even strengthening it to 50%, a 10 percentage point increase depending on household loan growth, would disrupt the profit structure.

A representative of a holding company-affiliated savings bank said, "We have no choice but to comply with the financial authorities' total volume regulations," and predicted, "Since the budget related to sales, including advertising expenses, has been cut, it will be difficult to grow more aggressively than in the first half."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)