BHP Group "Request for Mandatory Arbitration Period"

[Asia Economy Reporter Park Byung-hee] Workers at Escondida mine in Chile, the world's largest copper mine, have decided to go on strike, the Wall Street Journal reported on the 1st (local time). There are expectations that copper prices could surpass the all-time high recorded last May due to concerns over supply disruptions.

The Escondida union announced that following a vote among its members on the 31st of last month (local time), union members overwhelmingly rejected the company's wage proposal and resolved to strike. According to the union, in the vote asking whether to accept the company's proposal, 2,164 members voted against it, while only 11 voted in favor. The Escondida mine accounts for 5% of the world's copper supply and is the largest copper mine globally.

Under Chilean law, even if a union decides to strike, there is a mandatory mediation period of up to 10 days granted by the government. This means that even if Escondida union members decide to strike, the strike can effectively only begin after a maximum of 10 days. The union sometimes strategically chooses to resolve to strike.

BHP Group, the largest shareholder of the Escondida mine, stated that it will request the mandatory mediation process following the disclosure of the union vote results. BHP said, "The company's interest is to reach an agreement with the employees," adding, "We are willing to engage in dialogue with the union and will use all means to do so." BHP Group holds a 58% stake in the mine. Rio Tinto and Japan's Mitsubishi Group are also shareholders of the Escondida mine.

The union is reportedly demanding special bonuses based on performance and increased welfare benefits.

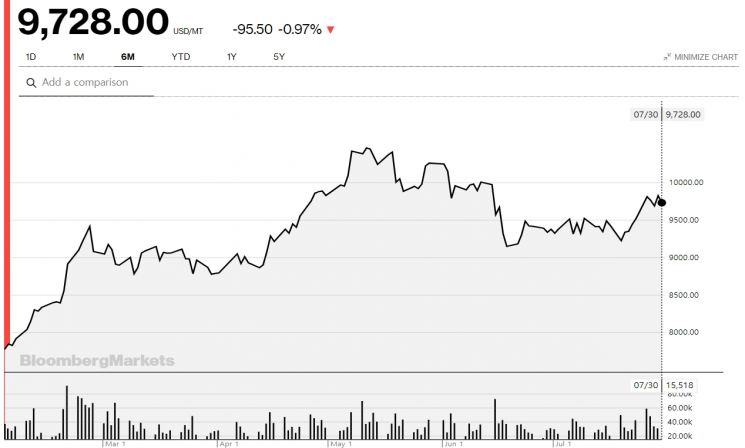

As the global economy rapidly recovered from the COVID-19 phase, prices of major raw materials including copper surged, leading to a sharp increase in profits for mining companies like BHP this year. Consulting firm PricewaterhouseCoopers (PwC) expects the pre-tax net profit of 40 global mining companies this year to reach a record high of $118 billion, a 68% increase from last year. Copper prices also broke the $10,000 per ton mark in May, setting a new record.

With rising copper demand, BHP did not halt operations at the Escondida mine even during the COVID-19 period. Operations were conducted with reduced workforce considering the pandemic. The union argues that due to this, workers’ working hours increased and they should receive fair compensation accordingly. The Escondida union previously went on strike for 44 days in 2017.

A BHP Group spokesperson stated in an email on the 30th of last month, while the member vote was ongoing, that "the company's proposal includes improvements to the current situation and new benefits on matters important to the workers." According to BHP, copper production at the Escondida mine decreased by 10% in the fiscal year.

Morgan Stanley explained that whether negotiations between the Escondida mine labor and management proceed will be a key variable in the short-term copper price outlook. After reaching an all-time high in May, copper prices weakened but have been rising sharply again since the end of last month due to supply disruption concerns from flooding in China and the weakening of the dollar. Last week, London Metal Exchange (LME) copper futures prices rose to a six-week high.

Sabrin Choudhury, an analyst at Fitch Solutions, predicted that if the Escondida mine union goes on strike, copper prices will surpass the all-time high recorded last May.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.