Base Rate Hike Imminent... Increased Exposure Despite Authorities' Warnings

[Asia Economy Reporter Kim Jin-ho] As of June, the proportion of variable interest rate loans among household loans reached the highest level in 7 years and 6 months based on new loan issuance. The Bank of Korea has strongly hinted at the possibility of raising the base interest rate within the year, raising concerns that interest burdens will increase, especially for borrowers engaged in so-called 'Yeongkkeul (borrowing to the limit)' and 'Debt Investment (borrowing to invest)'.

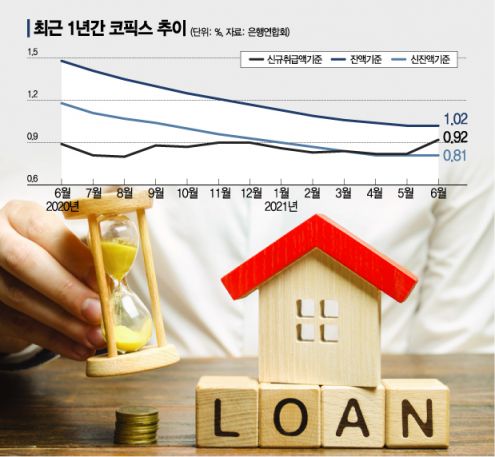

According to Bank of Korea statistics on the 2nd, variable interest rate loans accounted for 81.5% of new household loans from deposit banks in June, marking the highest level in 7 years and 5 months since January 2014 (85.5%).

Compared to the average proportion of variable interest rate loans among new household loans in 2019 and last year (63.8%, 53.0%), it has jumped by 20 to 30 percentage points within just 1 to 2 years.

Even based on the total outstanding household loan balance rather than new loans, the proportion of fixed interest rate loans in June (27.3%) was the lowest in 6 years and 9 months since September 2014 (27.2%). This means that 72.7% of the currently outstanding household loans are variable interest rate loans.

The high proportion of variable interest rate loans is a concerning point considering the rising interest rate environment. The Bank of Korea’s base interest rate hike is imminent, and the government has also been warning daily about the possibility of a sharp increase in household loan interest burdens due to rising rates, but this has little effect on borrowers’ choice of interest rates.

This is analyzed to be because the current gap between fixed and variable interest rates is larger than the potential future increases in variable interest rates that borrowers can anticipate over the next several years.

In fact, as of the 16th of last month, the COFIX-linked variable interest rate mortgage loans at the four major commercial banks?KB Kookmin, Shinhan, Hana, and Woori?were at an annual rate of 2.49% to 4.03%. However, the mixed-type (fixed interest rate) mortgage loans, which follow the 5-year bank bond rate rather than COFIX, have interest rates ranging from 2.89% to 4.48%, with both the upper and lower bounds more than 0.4 percentage points higher than the variable interest rates.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)