[Asia Economy Reporter Minji Lee] The market capitalization ratio of stocks held by foreigners has hit its lowest level in five years. This is analyzed to be influenced by increased interest in companies in developed countries with a high proportion of service industries, compared to emerging countries with a high proportion of manufacturing industries.

According to the Korea Exchange on the 1st, as of the 29th of last month, the proportion of stocks held by foreigners relative to the total market capitalization in the KOSPI market was 34.12%, the lowest since August 17, 2016 (34.03%). Although foreigners sold stocks worth 718.4 billion KRW on the 30th, the holding ratio recorded 34.13% due to the decline in the KOSPI.

Looking at the shareholding ratio, which is the proportion of stocks held relative to the total number of listed shares, it stood at 18.6% as of the 30th of last month, the lowest since May 3, 2018 (17.31%). Considering that Samsung Electronics' stock split (1 share → 50 shares) on May 4, 2018, caused a sharp increase in the number of shares held by foreigners, the foreign shareholding ratio is at its lowest since the 2010s.

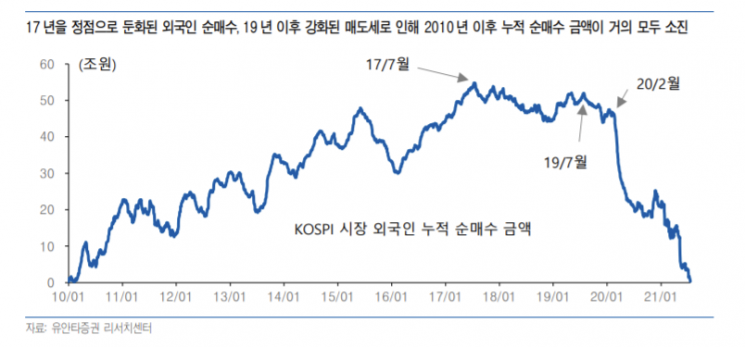

Researcher Byunghyun Cho of Yuanta Securities said, “After reaching a peak of 54.8 trillion KRW in cumulative net purchases in July 2017, the trend stagnated and then entered a downward phase from the second half of 2019,” adding, “Since the early 2020 spread of COVID-19, the selling pressure has intensified rapidly, almost reversing the cumulative net purchase volume accumulated over about eight years since 2010.”

Recently, foreigners have been increasing their net selling volume in the KOSPI market. Looking at monthly data since last year, foreigners showed a selling preference except in January, July, November, and April of this year. Recently, they have recorded net selling for three consecutive months. The foreign net selling dominance is analyzed to be due to risk-asset avoidance sentiment caused by the resurgence of COVID-19, the tapering (asset purchase reduction) issue leading to the weakening of the Korean won, and concerns about long-term low growth. Additionally, as trade barriers have increased, the attractiveness of emerging countries that served as 'factories' supplying products to developed countries like the U.S. has declined.

Researcher Cho explained, “In the past decade since the global financial crisis, it has been difficult for emerging markets with a high proportion of manufacturing industries to gain attractiveness,” and “Conversely, interest in large global companies in developed countries that hold the lead in the service industry has been easier to increase.”

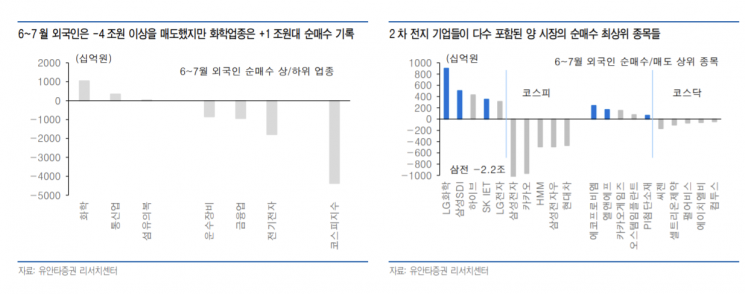

Among these, the secondary battery industry was identified as a sector that foreigners might be interested in. Recently, foreigners have net sold more than 4 trillion KRW in the domestic stock market since June, but they also net bought about 1 trillion KRW in the chemical sector. In the KOSPI market, they net bought LG Chem, Samsung SDI, and SK IE Technology, while in the KOSDAQ market, they net bought EcoPro BM, L&F, and PI Advanced Materials.

Researcher Cho said, “Regarding the secondary battery industry, which is the most notable in Korea, selective investments are being made,” and explained, “Interest is increasing in industries evaluated to have growth potential rather than expectations for cyclical economic momentum.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.