China's Private Education Regulations Trigger Sharp Decline in China and Hong Kong Stock Markets

Uncertainty Over US Debt Ceiling Suspension Negotiations

"Limited Impact on Domestic Companies, Decline Is Restrained"

[Asia Economy Reporter Minwoo Lee] The KOSPI, which had surpassed 3300 earlier this month, was pushed to the brink of breaking below 3200. It is analyzed that the decline in the Hong Kong stock market and the uncertainty surrounding the U.S. debt ceiling suspension negotiations acted as risk factors.

According to the Korea Exchange on the 31st, the KOSPI closed at 3202.32 on the 30th, down 1.24% from the previous day. This is the lowest closing price since May 28. Compared to the all-time high closing price of 3305.21 recorded on the 6th, it has fallen by about 3.12%. The 3200 level, which had been maintained for about two months, is now at risk of collapsing.

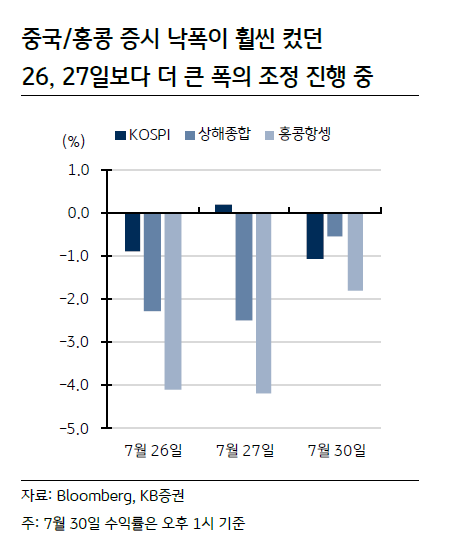

Regarding this, KB Securities judged that the impact of the Chinese government's corporate regulations is continuing. On the 24th, the Chinese government announced strong regulatory measures on the private education market, and since the 26th, the market capitalization of Chinese companies listed on mainland China, Hong Kong, and U.S. stock markets?mainly in technology, education, real estate, and bio sectors?has evaporated by more than 700 trillion won. It is analyzed that as long as these regulatory issues are not fully resolved, foreign capital will continue to withdraw from emerging market stock markets.

Hainhwan Ha, a researcher at KB Securities, explained, "Although the Chinese government has taken measures to stabilize the market, considering the Chinese government's intention to strengthen control over the market economy, it is difficult for investors to immediately regain trust in the Chinese financial market," adding, "The foreign selling, especially futures selling, seen the previous day reflects this sentiment." On the previous day, foreign investors net sold a total of 711.8 billion won in the KOSPI market alone. This was the largest single-day net sale since the 9th.

It was also analyzed that the end of the U.S. federal government's debt ceiling suspension period increased market anxiety. The Republican Party must agree to raise the debt ceiling or postpone the application of the statutory limit, but Senate Majority Leader Mitch McConnell hinted at the possibility of negotiation failure. Researcher Ha explained, "This is likely to act as a short-term noise in the stock market."

However, even if the unstable trend continues, the decline itself is expected to be limited. This is because the Chinese government's regulations are focused on the domestic economy, so the direct impact on South Korea's economy and companies is judged to be limited. The failure of the U.S. federal government's debt ceiling negotiations is also not seen as a major problem immediately, as the U.S. Treasury can use its cash reserves. Researcher Ha forecasted, "The U.S. Congressional Budget Office expects the Treasury's cash depletion point to be around October to November," adding, "Considering that the U.S. Congress recess ends on September 10, debt ceiling negotiations could take place between September and October."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.