Shinhan Financial Investment Report

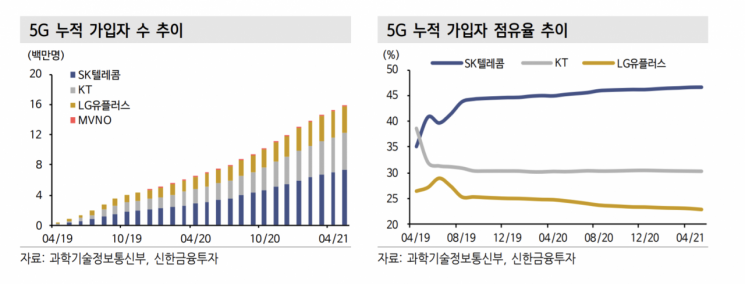

[Asia Economy Reporter Minji Lee] All three major telecom companies (KT, LG Uplus, SK Telecom) are expected to post solid second-quarter results due to an increase in 5G subscribers.

According to Shinhan Financial Investment on the 1st, the combined operating profit of the three telecom companies in the second quarter is projected to reach 1.1 trillion KRW, a 17% increase compared to the same period last year. All three companies are expected to continue growth compared to last year with results in line with market expectations.

Researcher Moonjong Lee of Shinhan Financial Investment explained, “Even without flagship smartphone launches, the replacement demand is expected to sustain an increase of around 700,000 5G subscribers per month, and the related marketing environment appears to have eased. Improvements in profitability and momentum expansion are also expected due to the strong performance of IPTV and non-telecom sectors.”

The securities industry estimates SK Telecom’s second-quarter operating profit at 405 billion KRW. Shinhan Financial Investment projects a higher figure of 415.5 billion KRW, a 15.6% increase year-on-year. Revenue is expected to rise 5.6% to 4.86 trillion KRW. The number of 5G subscribers is expected to remain stable at 300,000 per month. SK Broadband and ADT Caps are anticipated to have posted solid results, but 11st is expected to have conducted aggressive marketing due to intensified competition in the e-commerce market. Researcher Moonjong Lee said, “Starting next month, the launch of the Amazon Global Store and its linkage with paid memberships means that a short-term decline in profitability will not be a factor in lowering 11st’s corporate value.”

KT’s estimated operating profit is 415.9 billion KRW. Marketing expenses, which surged during the early launch of 5G, are estimated to have disappeared from the second quarter. Part of the marketing costs is capitalized and amortized according to the customer lifecycle, with KT’s amortization period being 21 months, the shortest compared to SK Telecom (26 months) and LG Uplus (24 months). The proportion and decline of fixed-line telephone revenue, which was a valuation discount factor, are also noticeably decreasing. Fixed-line telephone revenue this year is expected to be 1.46 trillion KRW, a 0.6% decrease compared to last year, which is estimated to be less than last year’s decline (-7.3%). Researcher Moonjong Lee explained, “The increase in subscribers to telephone access management services is also acting as a factor to defend against the decline in fixed-line telephone revenue. In the case of BC Card, there is also the possibility of highlighting the value of K Bank held after Kakao Bank’s listing.”

For LG Uplus, the estimated operating profit is 267.6 billion KRW. The net increase in 5G subscribers is expected to be 410,000. MVNO subscriber growth is also continuing, and wireless revenue is expected to reach 1.53 trillion KRW, a 7.5% increase compared to the same period last year. The researcher said, “Although the non-telecom sector was relatively sluggish, since the company announced plans to raise the related revenue proportion to 30% by 2025, if results in content and B2B become visible, valuation re-rating is possible.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.