[Asia Economy Reporter Ji Yeon-jin] Although Samsung Electronics' recent earnings expectations are rising, its stock price is showing weakness, drawing attention to other factors that increase corporate value.

According to the Korea Exchange on the 31st, Samsung Electronics has fallen nearly 3% so far this year until the previous day. Compared to the year's highest price on January 11, it is 13.63% lower.

As the undisputed number one in market capitalization in the domestic stock market, Samsung Electronics has been regarded as a stable investment destination as market uncertainty and fear increased. However, the current COVID-19 situation shows a different pattern from the past. Compared to March last year when the domestic stock market plunged due to the outbreak of COVID-19, Samsung Electronics' stock price rose 1.9 times, which is lower than the 2.25 times increase of the KOSPI during the same period. While Samsung Electronics' relative stability is likely at the peak of market fear, the speed of increase during the growth period depends on growth potential, according to interpretations.

Kim Jang-yeol, head of the Research Center at Sangsangin Securities, said, "In a situation where there is no significant change in existing business sectors, attracting investors requires concrete plans to enhance growth potential." He added, "Samsung Electronics mentioned in the Q2 earnings conference call that 'meaningful M&A possibilities within three years are viewed positively' and that it is reviewing M&A in various fields such as artificial intelligence (AI), 5th generation mobile communication (5G), and automotive electronics. However, since this M&A necessity has not newly emerged this year, it may be criticized for a lack of decisiveness."

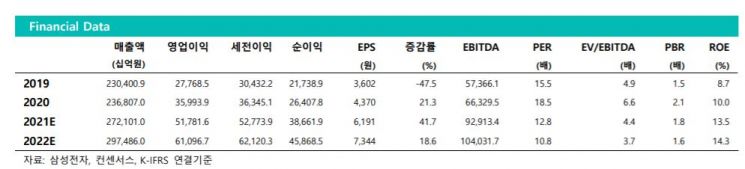

There is also criticism that if it is difficult to find sufficiently rewarding or promising investments in the short term, dividends should be raised more proactively. Another way to increase stock prices is through spin-offs of business units, which can reveal hidden value. In the past, scenarios such as display spin-offs or home appliance spin-offs were proposed, and recently, the possibility of spin-offs of non-memory and foundry businesses has been raised. Kim said, "If M&A or spin-offs become concrete, it is expected that a meaningful stock price rise trajectory will occur immediately," adding, "Conversely, without signs of such moves, it is difficult to gauge meaningful stock price growth potential based solely on earnings forecasts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.