Real Economy Declines After Five Months

Deputy Prime Minister Hong: "It's Regrettable to See Both Consumers and Businesses Psychologically Weakened"

[Asia Economy reporters Jang Se-hee and Moon Chae-seok] Corporate sentiment has declined for the first time in five months. The rise in raw material prices has increased cost burdens, and with the fourth wave of the COVID-19 pandemic causing domestic demand to slow again, corporate sentiment has weakened. In particular, the business sentiment outlook for next month has dropped further, raising the possibility of a "double dip" where the economy falls again in the second half of the year after a brief recovery. The Economic Sentiment Index (ESI), which reflects both consumer and corporate sentiment, also turned downward for the first time in seven months.

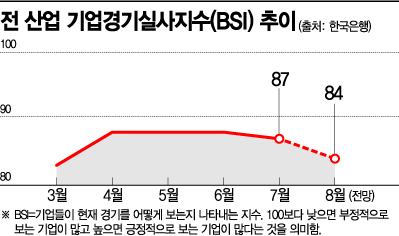

According to the "July 2021 Business Survey Index (BSI) and Economic Sentiment Index (ESI)" released by the Bank of Korea on the 30th, the overall industry BSI this month recorded 87, down 1 point from the previous month. With 100 as the baseline, a figure above 100 indicates more optimistic companies, while below 100 indicates more pessimistic ones. Although the decline is small, the fact that the overall industry BSI rose to 88 in April and remained flat until June before falling for the first time in five months is significant. Kim Dae-jin, head of the corporate statistics team at the Bank of Korea, explained, "Corporate sentiment appears to have been affected by the resurgence of COVID-19 and rising raw material prices."

The manufacturing sector BSI stood at 97, down 1 point from the previous month. By industry, declines were centered around apparel and fur, as well as rubber and plastics. By company size, large enterprises saw an increase, while small and medium-sized enterprises experienced a drop in sentiment.

The outlook for the economy is even more negative. The BSI for all industries' business outlook in August fell 6 points from the previous month to 84. Moreover, with the U.S. Department of Commerce announcing on the 29th (local time) that the preliminary growth rate for Q2 (April to June) was 6.5%, lower than initially expected, corporate sentiment is likely to cool further.

In this regard, Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, stated on his social media on the same day, "Although real indicators such as July exports and total card sales have not yet shown a clear impact, it is regrettable to see both consumers and companies somewhat psychologically restrained."

On the same day, Statistics Korea released the "June Industrial Activity Trends," reporting increases in both production and consumption. However, the fourth wave of COVID-19, which began in earnest this month, was not reflected. Eo Un-seon, director of the Economic Trend Statistics Review at Statistics Korea, said, "Most major indicators showed improvement in June, but uncertainty has increased due to the fourth wave of COVID-19. It is difficult to predict how the impact of the spread will unfold economically."

Meanwhile, Professor Lee Jong-hwa of Korea University’s Department of Economics pointed out, "If the prolonged COVID-19 pandemic increases corporate uncertainty about the future, companies may be reluctant to make long-term investments and may reduce hiring."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.