[Asia Economy Reporter Joeslgina] Samsung Electronics maintained its No. 1 position in the global smartphone market in Q2 (April-June), but the situation is not easy. Chinese Xiaomi, leading with low-price offensives, is rapidly closing the gap by expanding its market share. Apple, ranked third, is also expected to intensify competition with the launch of the 'iPhone 13' in the second half of the year, making the market competition even fiercer. Some analysts suggest that Samsung Electronics has been hit harder by the global semiconductor chip shortage compared to competitors including Apple.

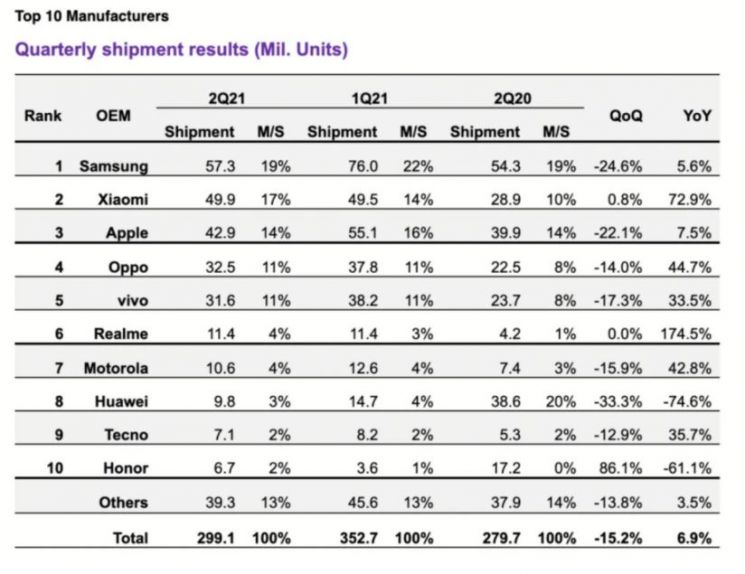

According to market research firm Omdia on the 29th (local time), global smartphone shipments in Q2 totaled 299.1 million units, a 6.9% increase compared to the previous year.

By manufacturer, Samsung Electronics held the top spot. Samsung shipped 57.3 million units in Q2, capturing a 19% market share. However, its growth rate of 5.6% compared to last year (54.3 million units) was below the overall average. Omdia attributed this to "the ongoing global component supply shortage and the impact of reduced operations at key facilities in India and Vietnam due to the spread of the COVID-19 Delta variant." This is also the background for the assessment that Samsung Electronics was more severely affected by the global semiconductor shortage. IT specialist media SamMobile evaluated, "Facing supply shortages and low inventory in key regions, the company's growth potential was limited," adding, "Samsung was hit harder by the global semiconductor shortage than Apple."

Samsung Electronics is placing its 'second half gambit' on new foldables such as the Galaxy Z Fold3 and Galaxy Z Flip3, scheduled to be unveiled at next month's Unpacked event, along with cost-effective models like the Galaxy S21 Fan Edition (FE) and Galaxy A52. Kim Sung-gu, Executive Vice President of Samsung Electronics' Mobile Business Division, responded to a question about production disruptions at overseas factories due to the resurgence of COVID-19 during the Q2 earnings conference call held yesterday morning, saying, "We are diversifying supply to India and Korea and securing additional supply sources to minimize impact, and we expect to return to normal operations by July."

Xiaomi's pursuit has also intensified. Its Q2 shipments reached 49.9 million units, surpassing Apple to claim second place. Despite the COVID-19 pandemic, Xiaomi showed an impressive 72.9% growth, attracting attention. Its market share jumped to 17%. The market share gap between Samsung Electronics and Xiaomi, which was 9 percentage points a year ago, has narrowed to 2 percentage points this year. This trend is also confirmed in reports from other market research firms such as Canalys released earlier.

Recently, Xiaomi's rapid growth is interpreted as due to a surge in sales outside the Asia-Pacific region. In particular, it is understood to have absorbed Huawei's market share, which is under strong sanctions from the U.S. government. IT specialist media PhoneArena stated, "Initially, many believed Samsung Electronics and Apple would capture most of Huawei's market share outside China," but added, "Xiaomi targeted this by focusing on the low-price segment and collaborating with mobile carriers." Huawei's smartphone shipments plummeted from 38.6 million units a year ago to 9.8 million units (8th place) in Q2 this year, a 74.6% drop. Its market share, which was about 20%, shrank to 3%.

Apple, which recently announced its largest-ever Q2 earnings, shipped 42.9 million iPhones, securing a 14% market share and ranking third. The recovery of demand in advanced markets such as the U.S. and strong growth in emerging markets contributed to a 7.5% year-on-year growth. Its market share remained the same as a year ago. Notably, Apple maintains leadership by holding the overwhelming No. 1 position in both shipments and sales in the rapidly growing 5G smartphone market. Apple's first 5G smartphone, the iPhone 12, has sold over 100 million units as of April this year. Apple plans to strengthen its offensive with the iPhone 13 in the second half of the year, which is also expected to achieve record-breaking sales.

China's Oppo and Vivo shipped 32.5 million and 31.6 million units respectively, ranking 4th and 5th. PhoneArena noted, "They showed significant growth by entering the European market amid Huawei's slump." Oppo's sub-brand Realme attracted attention with a shipment increase of 174.5%. Realme secured a 4% market share, solidifying its position as the world's 6th largest smartphone brand. Honor, a mid-to-low-end brand sold off from Huawei, shipped 6.7 million units in Q2.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.