WOS Acquired for 60 Billion KRW

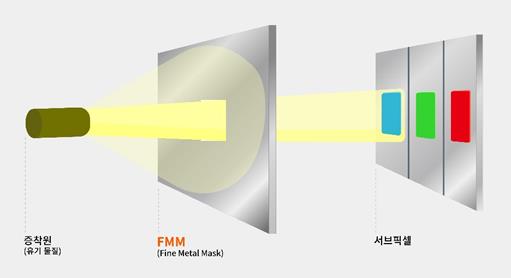

Secures FMM Technology, a Core OLED Component... Accelerates Localization of Materials, Parts, and Equipment

Solar Power Posts Losses for Three Consecutive Quarters... Raw Material and Logistics Cost Surge Cited as Causes

Polyethylene Market Expected to Weaken in Second Half of the Year

[Asia Economy Reporter Hwang Yoon-joo] Hanwha Solutions is entering the OLED materials market. Recently, it acquired a domestic small and medium-sized enterprise possessing essential technology for manufacturing OLED (Organic Light Emitting Diode) panels, a market that is rapidly expanding. Through this, the company plans to expand its electronic materials business from a mobile-centric focus to the display sector, which is expected to experience high growth.

◆ Securing FMM technology, a core component in the OLED process... Strengthening high value-added materials business = On the 29th, Hanwha Solutions held a board meeting and announced its decision to acquire 100% of the shares of Double WOS, a company possessing FMM (Fine Metal Mask) technology, a key material for OLED panel manufacturing, for 60 billion KRW.

Double WOS was established through a physical division of the OLED business sector of Wave Electronics, a KOSDAQ-listed company, in May. It began developing FMM technology in 2010 and has completed the development of a new technology using electroforming, but has faced difficulties in securing funding and has not actively invested in mass production. Hanwha Solutions plans to establish an FMM mass production system by 2022 and make additional investments worth several hundred billion KRW.

This acquisition is expected to accelerate the ongoing efforts to increase the value-added nature of chemical and electronic materials. Double WOS has successively developed high value-added chemical materials such as XDI (optical lens materials) and EcoDechi (eco-friendly plasticizer), and in April, recruited Hwang Jung-wook, former head of Samsung Electronics’ Future Strategy Division (President), to develop high value-added electronic materials.

The FMM technology held by Double WOS is evaluated as advantageous for realizing ultra-high-definition displays compared to Japanese companies currently monopolizing the market. While Japanese companies use an etching method that flows chemicals over metal plates to create patterns, Double WOS uses an electroforming method that applies electricity to a metallic solution to draw patterns. The thinner the FMM, the higher the density of RGB organic materials that can be stacked, and the electroforming method can make substrates more than 50% thinner than the etching method.

Currently, Japanese companies hold over 90% of the global FMM market share. Domestic display companies also import all FMMs required for panel manufacturing from Japan. Since the Japanese government began export restrictions on key parts and materials to Korea in 2019, there have been continuous calls within the domestic display industry to localize FMM production early.

According to market research firm UBI Research, the FMM market is growing at an average annual rate of 10% due to increased sales of smartphones, tablet PCs, smartwatches, and other devices applying OLED. In particular, as global IT companies recently expand the application of OLED panels in their products, there is analysis that the FMM market will grow even faster in the future.

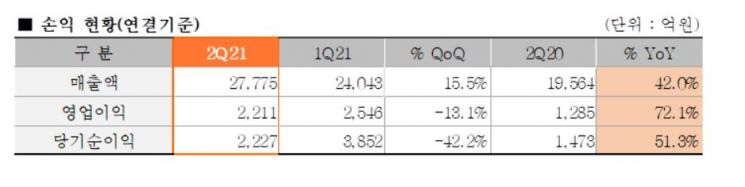

◆ Solar business expected to reduce losses after Q3... Chemical market outlook weak = Alongside this, Hanwha Solutions announced that its consolidated operating profit for the second quarter of this year reached 221.134 billion KRW, a 71.09% increase compared to the same period last year. During the same period, sales increased by 41.97% to 2.7774 trillion KRW, and net profit rose by 51.26% to 222.78 billion KRW, according to preliminary figures. As a result, operating profit for the first half reached 475.71 billion KRW, up 60.90%, and sales increased by 23.24% to 5.1817 trillion KRW.

By business segment, the chemical division recorded sales of 1.3331 trillion KRW, up 70.7% year-on-year, and operating profit of 293 billion KRW, a 215.7% increase. This was due to the continued effect of low-cost raw material inputs and strong prices for key products such as PVC (polyvinyl chloride) and caustic soda, driven by increased demand for industrial materials amid domestic and international economic recovery.

In the Q2 earnings conference call, Hanwha Solutions analyzed, "The polyethylene market is expected to weaken in the second half," adding, "If the economic recovery continues, the market is expected to absorb supply sufficiently next year." It emphasized two major variables affecting the polyethylene market: "The slow pace of vaccination in emerging countries, which slows economic recovery, and how quickly regional demand and supply gaps caused by maritime logistics disruptions are resolved."

The Q CELLS division posted sales of 1.0065 trillion KRW, a 35.5% increase compared to the same period last year, but recorded an operating loss of 64.6 billion KRW. Although it earned 22 billion KRW in operating profit through the sale of renewable energy generation assets, the solar module sales business failed to achieve profitability due to worsening external factors such as soaring prices of key raw materials (wafers, silver, aluminum) and logistics costs. In fact, the international price of polysilicon, a key raw material for solar cells, surged from around 7 USD per kg in June last year to about 28 USD per kg within a year, and international maritime freight rates increased approximately fourfold during the same period.

Losses are expected to narrow in the second half. In the Q2 earnings conference call, it was explained, "The deficit of Hanwha Q CELLS is expected to shrink in Q3," adding, "The direction of wafer and polysilicon prices will become clearer after September, but we anticipate price declines."

The advanced materials division recorded sales of 224.3 billion KRW and operating profit of 2.2 billion KRW. The Galleria division posted sales of 126.6 billion KRW, a 15.3% increase year-on-year, and turned an operating profit of 2.2 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)