Korea Federation of SMEs Announces Results of August Small Business Economic Outlook Survey

[Asia Economy Reporter Kim Bo-kyung] Due to the resurgence of COVID-19 and other factors, the business outlook for small and medium-sized enterprises (SMEs) has worsened for three consecutive months. In particular, domestic demand contraction factors such as the implementation of Level 4 social distancing in the Seoul metropolitan area are expected to severely impact the lodging and restaurant industries.

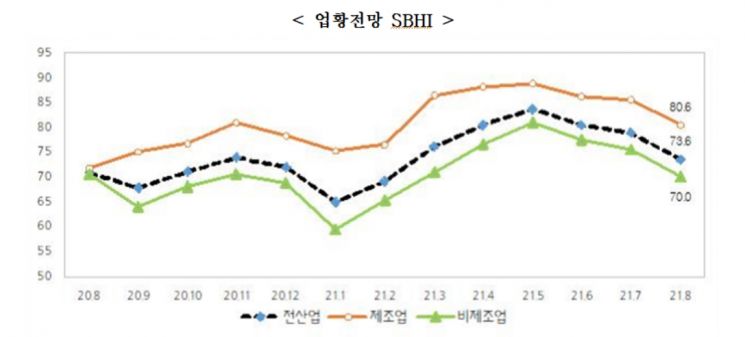

The Korea Federation of SMEs announced on the 29th that, based on a survey conducted from the 15th to the 22nd of this month targeting 3,150 domestic SMEs, the business outlook index for August fell by 5.3 points from the previous month to 73.6.

If this index is above 100, it means that more companies have a positive business outlook than those who do not; if it is below 100, the opposite is true.

The business outlook index has declined for three consecutive months, following sharp rises in raw material prices and shipping and logistics difficulties in June and July.

The Federation analyzed, "Since July, the strengthening of social distancing measures such as operating hour restrictions due to the fourth wave of COVID-19 has added to domestic demand contraction factors, negatively affecting the overall industry's perceived business conditions."

The business outlook index for manufacturing in August was 80.6, down 4.9 points, while non-manufacturing was 70.0, down 5.5 points.

In particular, the lodging and restaurant industries, which are representative sectors affected by strengthened social distancing, plunged by 32.1 points to 44.0. This is the largest drop since the survey began.

The main management difficulties faced by SMEs (multiple responses allowed) were domestic demand slump at 60.4%, followed by rising labor costs (42.3%), excessive competition among companies (40.8%), and rising raw material prices (38.5%).

The Federation explained, "The response indicating rising labor costs increased by 3.5 percentage points compared to the previous month due to the expanded introduction of the 52-hour workweek system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.