2Q Foundry Records Highest Sales

Strong Demand and Price Increase for Server D-RAM Effective

Annual D-RAM Bit Growth Mid-20% and NAND in 40% Range Expected

Foundry Expands Advanced Processes with 5nm 2nd Gen and 4nm 1st Gen

[Asia Economy Reporters Su-yeon Woo and Hyun-jin Jeong] The semiconductor division, which posted nearly 7 trillion won in operating profit, played a major role behind Samsung Electronics' surprise operating profit of over 12 trillion won in the second quarter of this year. With the semiconductor division's quarterly performance recovering to the level of the 2018 supercycle, expectations are rising that the company's total operating profit could surpass 50 trillion won this year.

In the earnings announcement for the second quarter on the 29th, Samsung Electronics addressed recent concerns about the peak in DRAM prices, stating, "Although various risk factors remain, market demand fundamentals are expected to remain solid in the second half," expressing confidence in the continuation of a positive market environment. While semiconductors will continue to lead performance in the second half, all business divisions including Display (DP), Consumer Electronics (CE), and IT & Mobile (IM) are expected to grow steadily, leading to a further leap in annual results.

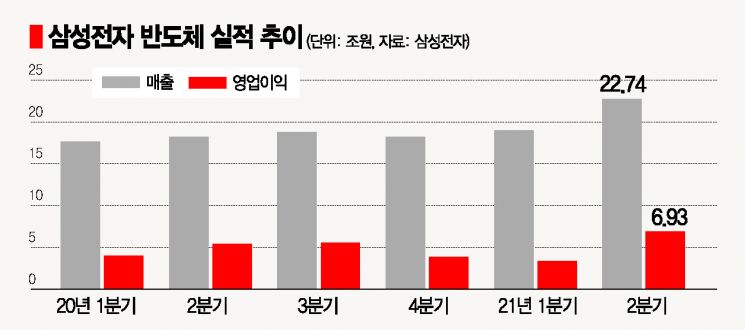

◆Semiconductors Recreate Supercycle Glory... Foundry Achieves Record Sales= Semiconductor sales in the second quarter reached 22.74 trillion won, with operating profit at 6.93 trillion won, marking increases of 24% and 27% respectively compared to the same period last year. The second quarter results have risen to the level of the latter half of 2018, which was the end of the previous supercycle. The DP and CE divisions also maintained solid momentum with operating profits in the trillion-won range.

Global foundry supply shortages and the memory semiconductor boom began last year, but interpretations suggest that Samsung Electronics started to benefit from the market improvement in earnest from the second quarter of this year. In particular, foundry sales in the second quarter achieved an all-time high. Although the first quarter was affected by the suspension of operations at the U.S. foundry plant, preventing full enjoyment of the boom, the second quarter saw a complete normalization.

Memory semiconductor shipments also exceeded guidance, driven by strong demand centered on server DRAM, and cost reductions through increased proportions of advanced processes contributed to performance improvements. Additionally, profitability improved due to the sharp rise in DRAM and NAND prices. The fixed price of DRAM (DDR4 8Gb) in the second quarter rose by more than 26% compared to the first quarter. A fixed price increase of over 20% in a short period has not occurred since the first quarter of 2017 (38%) in over four years.

◆The Era of 50 Trillion Won Operating Profit for the Entire Company Arrives This Year= It is no exaggeration to say that Samsung Electronics' annual performance outlook this year depends on semiconductors. Samsung expects to open the era of 50 trillion won in annual operating profit by pursuing qualitative improvements in system semiconductors and foundry divisions based on solid demand for memory semiconductors.

During the conference call, Samsung Electronics stated that the annual demand bit growth rate for DRAM is expected to be in the mid-20% range, and NAND flash around 40%. Jinman Han, Vice Chairman of Samsung Electronics, said, "The technological competitiveness of V-NAND is not about the number of layers alone but how efficiently the stacks are built," adding, "We are focusing on securing technological competitiveness in terms of efficiency and cost."

With shipment volumes exceeding expectations and inventory levels significantly reduced through the second quarter, Samsung plans to secure volume and cost competitiveness by expanding its main processes of 15nm DRAM and 128-layer V-NAND. Additionally, based on the industry's smallest line width process achievable in the 14nm range, Samsung plans to begin mass production of 14nm DRAM with EUV (Extreme Ultraviolet) lithography applied to five layers in the second half of the year.

In the system semiconductor division, Samsung aims for double-digit annual sales growth through flexible price adjustments focused on high-end products. Foundry, which achieved record quarterly sales in the second quarter, is expected to continue experiencing supply shortages in the second half. Samsung anticipates more than 20% growth in foundry sales compared to last year. By ramping up shipments of products from the Pyeongtaek foundry line and actively utilizing advanced processes such as the second generation 5nm and first generation 4nm, Samsung plans to maximize supply capacity.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.