Repetition of Existing Claims on Market Distortion Issues, Emphasis on Restraint from Chase Buying

Seoul Apartment Prices Rose 85% Under Moon Government "Trusting Government Led to Sudden Poverty"

First-Time Buyers Account for 32.7% in First Half of This Year... Leading Indicators Also Rising Simultaneously

[Asia Economy reporters Kangwook Cho and Sunhee Son] "This is not about COVID-19 prevention... How can they ask the public to participate in stabilizing housing prices?" (Housewife A, resident of Seongnam-si, Gyeonggi Province)

This is the market's reaction to Deputy Prime Minister and Minister of Strategy and Finance Hong Nam-ki's public statement on real estate on the 28th. "After pouring out all kinds of measures without success, are they now threatening the public by telling them 'do not buy houses'?"

Despite the unprecedented 'housing price statement' involving Deputy Prime Minister Hong and all related ministers, housing prices are soaring. Contrary to the government's confident assurances, experts criticize that those who did not buy houses have fallen into the 'asset-poor class' during the four years since the Moon Jae-in administration took office.

◇ Government repeats that housing price increases are due to "psychology and speculation" = In his public statement, Deputy Prime Minister Hong reiterated the existing argument that market distortion is a bigger problem than supply and demand. The emphasis was on appealing to refrain from speculative buying driven by unstable psychology rather than price stabilization policies.

According to the government, this year's housing supply is 460,000 households nationwide and 83,000 households in Seoul. This is similar to the average housing supply over the past 10 years, so the government’s position is that there is no shortage of supply. Hong said, "Under circumstances where speculative demand, illegal transactions, and expectation psychology significantly drive price increases, housing prices cannot continuously rise."

However, contrary to the government's claim that market disruption activities such as 'inflating actual transaction prices' are the main culprits driving up real estate prices, only 12 cases were detected through a full investigation of about 710,000 apartment transactions over the past five months. This is why there are criticisms that the government only embarrassed itself by trying to shift the blame for its real estate policy failures onto speculative forces.

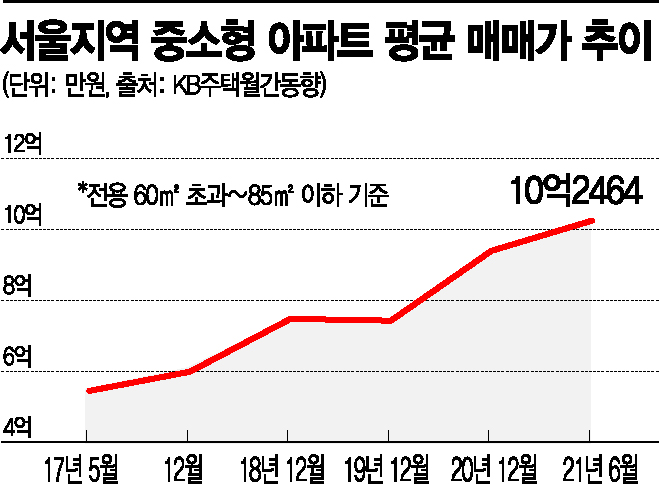

◇ Housing prices doubled during the four years of the Moon administration = Although the government recently described the rapid rise in real estate prices as an 'abnormal phenomenon,' the housing price curve has sharply soared under the current administration. According to KB Live Real Estate, the average sale price of small and medium-sized apartments in Seoul last month was 1,012.62 million KRW, surpassing 1 billion KRW for the first time ever. Compared to May 2017, when the Moon administration took office (544.64 million KRW), it rose by nearly 500 million KRW, an increase of 85%.

The number of apartments priced below 600 million KRW, the standard for low- and middle-priced housing in Seoul, is also rapidly decreasing. 600 million KRW is the threshold for the Bogeumjari Loan, which allows low- and middle-income real demand buyers to get low-interest loans. According to Real Estate 114, the proportion of apartments priced below 600 million KRW was 62.7% in May 2017 but only 14.4% last month. More than 80,000 apartments priced below 600 million KRW in Seoul have disappeared just this year.

◇ "I became a fool for trusting the government"... Lost trust in policy = The reason the government's repeated warnings about the 'housing price peak' are ineffective is that trust in policy has plummeted due to the failure of as many as 25 real estate measures. In the market, there are even comments like, "We became fools and broke overnight by trusting the government, so how can we believe their warnings now?"

In fact, in the first half of this year, first-time homebuyers in Seoul accounted for 48,679 people, or 32.7% of the total, steadily increasing from 24.4% in the first half of 2019 and 26.6% in the first half of last year. Especially among first-time homebuyers in Seoul, those in their 30s nearly doubled from 25,121 in the first half of 2019 to 49,068 in the first half of this year in just two years.

Various leading indicators forecasting future housing prices are all rising. The Housing Price Expectation Consumer Sentiment Index (CSI) announced by the Bank of Korea on this day recorded 129 in July, rising 2 points from the previous month and continuing an increase for three consecutive months. The 'Sales Supply and Demand Index' showing apartment buying sentiment in Seoul surveyed by the Korea Real Estate Board and the Seoul Sales Outlook Index surveyed by KB Kookmin Bank among brokerage offices both rose for three consecutive months from April to June.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.