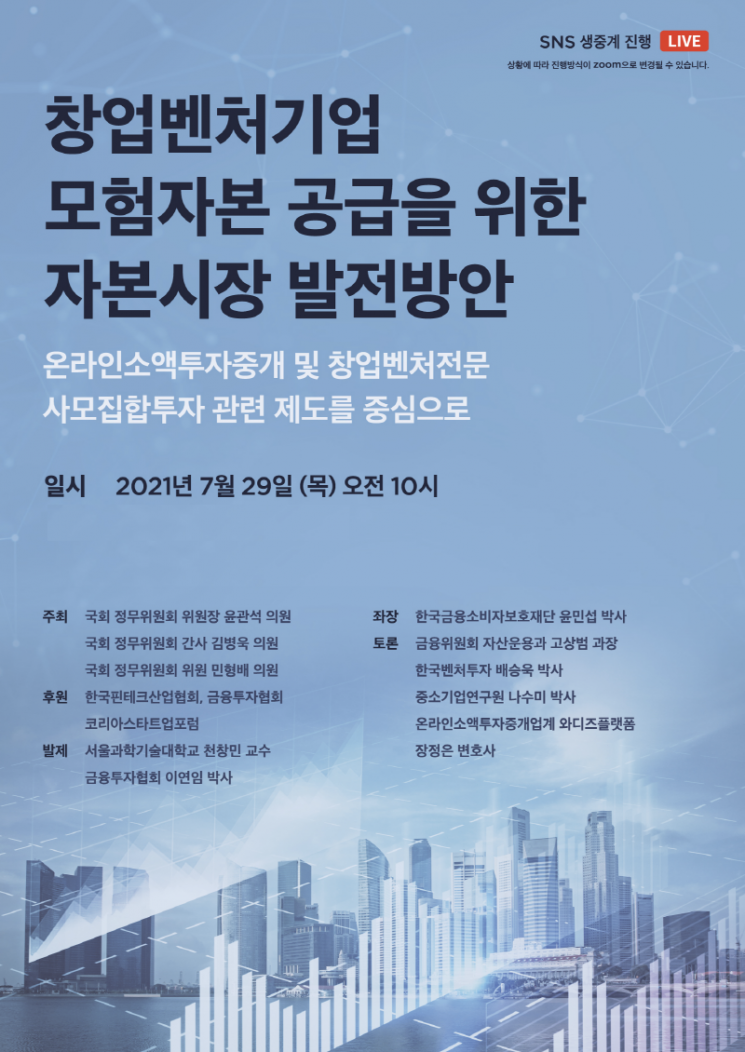

[Asia Economy Reporter Kim Hyo-jin] The Korea Fintech Industry Association announced on the 28th that it will hold a forum at the National Assembly on the 29th, together with the Korea Financial Investment Association and the Korea Startup Forum, under the theme of ‘Capital Market Development Measures for Supplying Venture Capital to Venture Companies.’

This forum was organized to review the status of the ‘securities-type crowdfunding’ system, introduced to revitalize funding for startups and venture companies, after five years of implementation, and to gather opinions on policies and legislative tasks that can improve and foster it. In addition, it plans to explore improvement tasks to preserve the original purpose of startup venture specialized private equity funds following the recent restructuring of the private equity fund system.

‘Securities-type crowdfunding’ is a funding method where startups and venture companies publicly issue securities to multiple investors online and receive small investments. It was institutionalized through the revision of the Capital Markets Act on January 25, 2016.

Since its introduction, it has emerged as a useful funding channel for startups that found it difficult to raise funds from regulated financial institutions, and has had positive effects such as allowing individual investors to directly acquire startup stocks. However, concerns have been raised about growth stagnation recently due to the impact of COVID-19 and sluggish system improvements.

The startup venture specialized private equity fund system was also implemented as a special case under the Capital Markets Act in January 2017 and received much attention from the early venture investment industry. However, its utilization has been low due to strict member qualification restrictions and relatively limited tax benefits compared to other systems, raising the need for improvement.

At this forum, discussions will focus on the securities-type crowdfunding and startup venture specialized private equity fund systems, which are representative systems related to startups and ventures under the Capital Markets Act, aiming to activate private capital inflow into the startup venture investment market. Key improvement measures to be explored include ▲current status of overseas securities-type crowdfunding system improvements ▲rationalization of issuance limit calculation and disclosure ▲and member and operation methods of startup venture specialized private equity funds.

The forum is co-hosted by National Assembly members Yoon Kwan-seok, Kim Byung-wook, and Min Hyung-bae of the Political Affairs Committee, with Dr. Yoon Min-seop of the Korea Financial Consumer Protection Foundation serving as the moderator. Following presentations by Professor Cheon Chang-min of Seoul National University of Science and Technology and Dr. Lee Yeon-im of the Korea Financial Investment Association, discussions will be held with participants including Mr. Go Sang-beom, Director of Asset Management Division at the Financial Services Commission, Dr. Bae Seung-wook of Korea Venture Investment Corp., Dr. Na Su-mi of the Small and Medium Business Research Institute, and lawyer Jang Jeong-eun from the industry’s Wadiz.

Jang Sung-won, Secretary General of the Korea Fintech Industry Association, said, “We hope this forum will explore practical measures to revitalize the securities-type crowdfunding and startup venture specialized private equity fund systems, and serve as a catalyst for more private capital to flow into a healthy innovative capital market, contributing to the growth of startups and venture companies.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)