[Asia Economy Reporter Lee Seon-ae] The Korea Securities Depository announced on the 28th that the fund profit dividends paid in the first half of this year amounted to 15.9128 trillion KRW. This is an increase of 65.8% compared to the first half of last year (9.5972 trillion KRW).

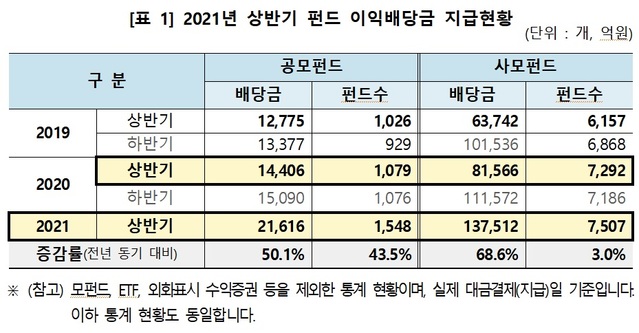

According to the Depository, public offering funds paid 2.1616 trillion KRW, and private equity funds paid 13.7512 trillion KRW. These represent increases of 50.1% and 68.6%, respectively, compared to the same period last year. The dividend amount of private equity funds is approximately 6.4 times that of public offering funds.

Based on the number of funds paying dividends, there were 1,548 public offering funds and 7,507 private equity funds. These figures increased by 43.5% and 3.0%, respectively, compared to the same period last year.

The new setup amount for public offering funds was 3.5758 trillion KRW, a decrease of 16.8% from last year. The liquidation distribution amount increased by 35.7% to 2.5953 trillion KRW.

The new setup amount for private equity funds was 29.9639 trillion KRW, and the liquidation distribution amount was 15.3949 trillion KRW. These represent decreases of 3.0% and 38.7%, respectively, compared to the same period last year.

The number of newly established funds has continued to decline, with 3,880 in 2019, 1,438 (-63%) last year, and 1,304 (-9.3%) this year as of the first half.

A Depository official explained, "The decrease in the liquidation distribution amount and the number of liquidated private equity funds appears to be due to the postponement of redemption payments and the sharp decline in the number of newly established funds since last year."

Of the fund profit dividends paid in the first half of this year (15.9128 trillion KRW), 8.3573 trillion KRW was reinvested in the respective funds, accounting for 52.5% of the total dividends. The reinvestment amount refers to the portion of profit dividends reinvested into the funds.

The reinvestment amounts were 1.8961 trillion KRW for public offering funds and 6.4612 trillion KRW for private equity funds. The reinvestment rates were 87.7% (public offering funds) and 47.0% (private equity funds), respectively.

A Depository official analyzed, "The low reinvestment rate of private equity funds seems to be due to the high proportion (60%, 4,599 funds) of real estate and special asset funds, which are difficult to reinvest."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.