To Receive More Initially Due to Income Gaps, Choose 'Initial Increase Type'

If Worried About Purchasing Power Decline from Inflation, Choose 'Regular Increase Type'

[Asia Economy Reporter Kwangho Lee] The Korea Housing Finance Corporation announced on the 28th that it will launch a new housing pension next month on the 2nd, allowing individuals to choose their pension receipt method according to their economic activities and financial circumstances.

The housing pension is a financial product guaranteed by the government that allows homeowners to provide their home as collateral and receive a fixed monthly amount like a pension for life through loans from financial institutions.

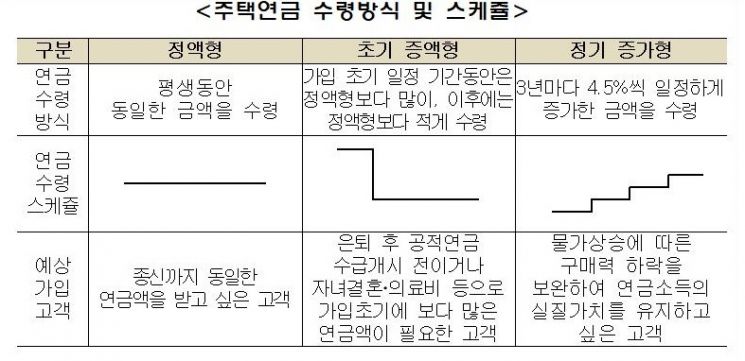

The newly introduced housing pension receipt methods refer to options for receiving the total pension amount (pension loan limit) determined at the time of enrollment either evenly throughout life, more in the early years, or more in the later years. Since the pension loan limit is the same regardless of the payment type, if a subscriber chooses to receive more initially, they should be aware that the amount will decrease accordingly later.

The Korea Housing Finance Corporation will maintain the popular fixed amount type and introduce an 'initial increased type,' which allows choosing a period of 3, 5, 7, or 10 years to receive more initially, and a 'regular increase type,' which periodically raises the pension amount to compensate for purchasing power decline due to inflation.

For example, a 60-year-old homeowner with a house valued at 500 million KRW who subscribes to the 5-year initial increased type will receive about 1,362,000 KRW per month for 5 years, approximately 28% more than the fixed amount type (1,061,000 KRW), and from the 6th year onward, will receive a reduced amount of about 953,000 KRW, which is 70% of the initial amount, for life.

The initial increased type can be effectively used when there is an income gap after retirement until receiving other pensions such as the National Pension, or when elderly subscribers expect additional expenses like medical costs.

Also, a 60-year-old homeowner with a 500 million KRW house subscribing to the regular increase type will start with a lower initial amount of 878,000 KRW compared to the fixed amount type (1,061,000 KRW), but from age 75, will receive 1,094,000 KRW, higher than the fixed amount type, and at age 90, will receive 1,363,000 KRW.

Therefore, the regular increase type can be useful for those concerned about purchasing power decline due to inflation after subscribing to the housing pension or who want to prepare for increased living expenses such as medical costs.

President Junwoo Choi said, "By launching the initial increased and regular increase types of housing pensions, we have expanded subscribers' choices, enabling them to use the housing pension more diversely and securely. We will continue to listen to the voices of the people and strive to improve the system to meet their needs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)