Q2 Sales of 94 Trillion Won... Operating Profit Margin of 43.3%

[Asia Economy Reporter Kim Suhwan] Apple’s Q2 revenue increased by 36% compared to the same period last year. As a result, Apple recorded its highest-ever revenue for Q2, significantly surpassing market expectations.

On the 27th (local time), Apple announced its Q2 (Apple’s own Q3) earnings reflecting this information.

Apple’s total revenue reached $81.41 billion (approximately 94 trillion KRW), exceeding Wall Street’s estimate of $73.3 billion (approximately 85 trillion KRW). Earnings per share (EPS) stood at $1.30, far surpassing the forecast of $1.01.

The operating margin was recorded at 43.3%.

This sharp increase in revenue was influenced by a substantial rise in sales of key products such as the iPhone.

iPhone sales amounted to $39.57 billion (approximately 46 trillion KRW), marking a 49.8% increase compared to the same period last year.

Additionally, sales of the iPad ($7.37 billion) and Mac ($8.24 billion) rose by 12% and 16% year-over-year, respectively, driving Apple’s overall performance upward.

The services segment, which includes Apple Music, cloud services, and advertising, also saw revenue increase by 33% year-over-year to $17.48 billion (approximately 20 trillion KRW).

Apple stated that the number of paid subscribers registered for its services reached 700 million, an increase of 150 million compared to the same period last year. This figure includes users who subscribe regularly to paid Apple applications.

Apple reported that revenue in the Greater China region, including Taiwan and Hong Kong, reached $14.76 billion (approximately 17 trillion KRW), a 58% surge year-over-year. However, some analysts note that this reflects a base effect due to lockdown measures implemented in China last year amid the COVID-19 outbreak.

Apple also stated that revenue in the North American region rose by 33% year-over-year to $39.57 billion (approximately 46 trillion KRW).

Although Q2 is typically considered a slow season, Apple’s sales exceeded expectations in this earnings report, demonstrating better-than-anticipated results.

CNBC reported, “With remote work and distance learning continuing, Apple appears to have benefited from a positive spillover effect.”

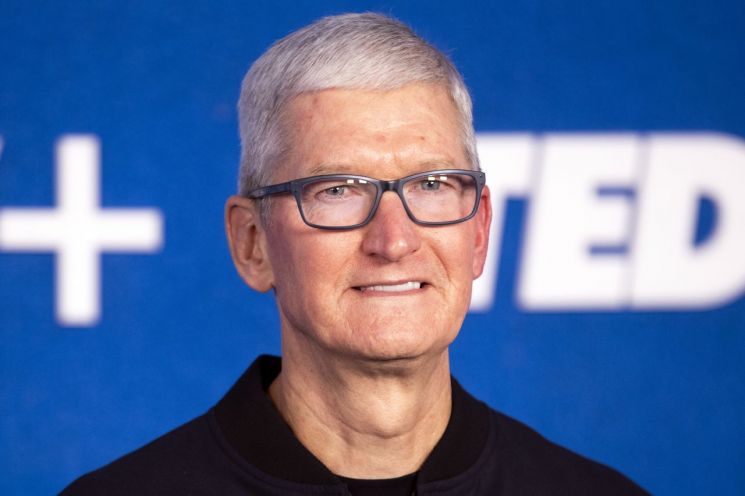

Furthermore, Apple revealed that the number of new consumers trying its products for the first time has significantly increased. Apple CEO Tim Cook said, “Switchers?consumers moving from Android to Apple products?grew by double digits.”

However, there are also forecasts that the ongoing global semiconductor supply shortage may negatively impact Apple’s product sales to some extent.

During the earnings announcement, CEO Cook said, “Due to the semiconductor supply shortage, the growth rate of iPhone and iPad sales in Q3 may be reduced.”

Apple CFO Luca Maestri also projected that Q3 revenue growth would be lower than the 36% recorded in Q2, citing semiconductor shortages and a slowdown in the services segment as key factors.

Apple announced it will pay shareholders a dividend of $0.22 per share.

Meanwhile, amid the industry-wide extension of remote work due to the spread of the Delta variant, Apple also announced it will postpone its office return schedule from the originally planned September to October.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.