"Easy and Convenient" Variable Insurance Enhancement Strategy

Advancing Non-Face-to-Face Systems... AI-Based Fund Management Also

[Asia Economy Reporter Oh Hyung-gil] Following the surge in sales of variable insurance in the life insurance market after the COVID-19 pandemic, small and medium-sized life insurance companies have embarked on multifaceted innovation efforts to sustain the popularity of variable insurance. Their strategy is to enhance systems so that subscribers can more conveniently enroll in variable insurance and easily manage their products remotely.

According to the insurance industry on the 28th, KB Life has started developing the ‘WISE Fund Management’ system to manage variable insurance funds. This system focuses on consumer convenience.

Through a mobile application (app), customers will be able to directly check their variable insurance fund contract details and view fund status and available fund options at a glance. Additionally, the system aims to facilitate comparing returns by fund and changing funds, which are the most important aspects of variable insurance.

KB Life posted a net loss of 11 billion KRW in the first half of this year, turning to a deficit compared to a net loss of 11.8 billion KRW in the same period last year. This deficit is unavoidable for market expansion. As new contract performance increased through corporate agencies (GA) and KB Kookmin Bank’s bancassurance (insurance sold through banks), commissions paid to these channels also increased.

Hana Life aims to improve customer profitability by introducing artificial intelligence (AI) into variable insurance, recommending variable insurance funds and rebalancing funds. Hana Life’s AI Global Equity Variable Asset Management diversifies investments through global ETFs while providing functions to prepare for downside market risks.

Hana Life’s net profit in the first half of this year was 20.9 billion KRW, a 10.3% decrease compared to the same period last year. However, it succeeded in improving its product portfolio centered on variable insurance. Special account income commissions from variable insurance and retirement pensions surged by 141.5% year-on-year to 44.2 billion KRW.

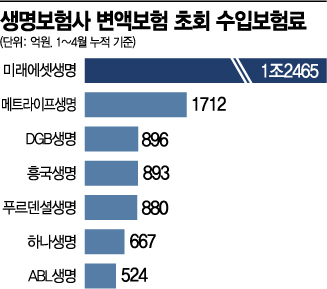

DGB Life has also been focusing on expanding its share of variable insurance since last year. After recording 144.9 billion KRW in initial premiums for variable insurance last year, it collected 89.6 billion KRW in initial premiums through April this year. This scale ranks among the top in the life insurance industry. Under the leadership of CEO Kim Seong-han, who took office in September last year, DGB Life raised the proportion of variable insurance sales to 70% on a monthly payment basis.

Initial premiums for variable insurance have surged this year. From January to April, domestic life insurers received 1.9682 trillion KRW in initial premiums for variable insurance, more than doubling compared to 721.8 billion KRW in the same period last year.

An industry insider said, "Interest in whole life insurance has decreased significantly compared to before, and consumer interest in variable insurance has grown recently due to the stock market boom. We are strengthening fund management through AI-based robo-advisors and focusing on developing consumer-friendly services."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.