[Asia Economy Reporter Ji-hwan Park] Recently, cases of companies that are difficult to explain using traditional corporate valuation models have emerged in IPOs (Initial Public Offerings) and M&As (Mergers and Acquisitions), raising calls for establishing new corporate valuation methods for new growth companies.

According to the report "The New Valuation Era: Valuing New Growth Companies" published by Samjong KPMG on the 27th, emerging startups and other new growth companies possess industrial characteristics different from those of the past. It is analyzed that applying traditional corporate valuation methodologies has limitations because it is difficult to objectively estimate future cash flows or appropriate discount rates at the pre-revenue or early revenue stages.

Since the second half of last year, amid the rapid recovery of global stock markets, the active IPO boom of venture companies has attracted significant attention both domestically and internationally. Corporate information provider PitchBook analyzed that the amount of venture capital exits in the U.S. reached a historic high of $290.1 billion in 2020. Of this, 76.5% of funds were recovered through IPOs in the stock market, and the median offering amount also increased by 42.6% year-on-year to $523.5 million.

As unicorn companies and the growth potential of new industries have drawn considerable market attention, discussions on the appropriateness of corporate valuations have also become active. Attempts are being made to modify assumptions of traditional valuation methodologies to reflect the characteristics of new growth companies and to consider variables related to new industry traits such as the number of customers or subscribers. Valuation methods that incorporate non-financial information such as future uncertainties, managerial capabilities, business ideas, and technology value are also continuously being developed.

Samjong KPMG stated, "There is no perfect single valuation methodology for new growth companies," and recommended, "It is necessary to pursue new perspectives on changing valuation factors while complementarily utilizing various approaches to approach corporate valuation."

Among new growth industries, e-commerce and delivery sectors were introduced as representative sectors where new corporate valuation methodologies are being applied. The listing of Coupang on the New York Stock Exchange has highlighted the need for new angles in valuing e-commerce companies. Traditionally, retail companies have estimated corporate value based on profitability indicators such as EV/EBITDA (Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization). However, e-commerce companies, which have high investment costs in infrastructure such as logistics and technology and have yet to generate profits, require new valuation methods. Currently, many investors use sales-related indicators rather than profits when measuring the value of e-commerce companies. Among sales-related indicators, GMV (Gross Merchandise Volume), which represents total transaction volume, is mainly used in e-commerce company valuations.

In the case of delivery service providers such as LMD (Last Mile Delivery) startups, the number of delivery orders and transaction amounts increase with subscriber growth, but from a profitability perspective, these platform companies inevitably incur losses until economies of scale are achieved. Accordingly, it has been pointed out that traditional valuation methods such as EBITDA multiples cannot adequately assess the growth potential of these companies. Currently, valuation methods for delivery service providers often use the average monthly delivery volume for about six months prior to the investment date as a basis.

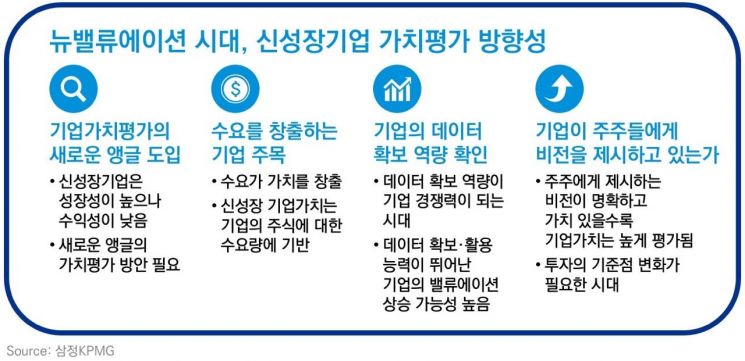

The report suggested four directions for valuing new growth companies: ▷introducing new valuation angles ▷focusing on companies that create demand ▷verifying companies’ data acquisition capabilities ▷assessing whether companies present a vision to shareholders.

Kim Yi-dong, Vice President and Head of the M&A Center at Samjong KPMG, said, "New growth companies have high growth potential but low profitability, necessitating valuation approaches from new angles. We are entering an era where corporate value is evaluated based on the demand for company shares, so valuation should focus more on the ‘supply and demand’ surrounding company shares." He added, "Attention should be paid to the rising value of companies with data acquisition advantages, and it is also important to closely observe what vision new growth companies present to their shareholders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.