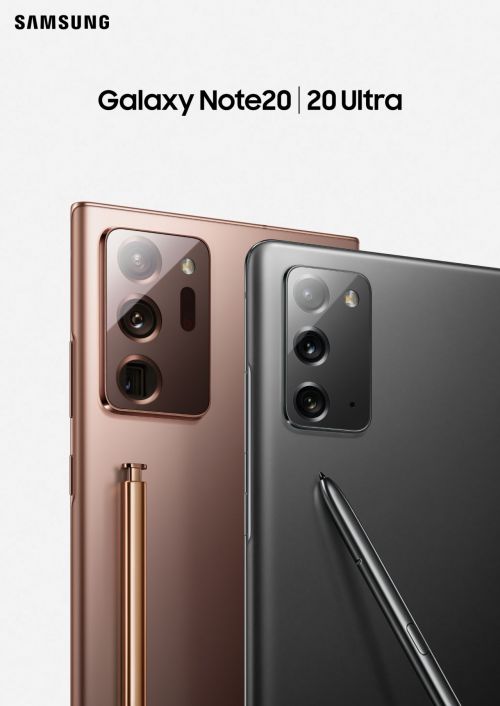

[Asia Economy Reporter Joselgina] In India, the world's second-largest smartphone market, the price of Samsung Electronics' flagship smartphone, the Galaxy Note20, has been reduced by more than 300,000 KRW.

On the 26th (local time), IT specialized media 91mobiles reported that the online store price of the Galaxy Note20 in the Indian smartphone market was lowered from 76,999 rupees (approximately 1,195,000 KRW) to 54,999 rupees (about 854,000 KRW). The offline store price is 59,999 rupees (approximately 931,000 KRW).

The price will be applied starting today. Given that there are no plans to release a new Galaxy Note model in the second half of this year, this is considered a significant price cut. 91mobiles described it as a "surprising price reduction," stating, "The Samsung Galaxy Note20 was released last August, and due to the global semiconductor shortage, no new Note series will be launched this year."

In the Indian market, the Galaxy Note20 is sold in an 8GB+256GB configuration. However, despite its premium price range, it does not support 5G. The Galaxy Note20 Ultra 5G, which supports 5G, has not had its price reduced even once locally, the media added.

Samsung Electronics currently ranks second in the Indian market. Trailing the number one Xiaomi by double digits, it is caught in a sandwich between rapidly advancing Chinese manufacturers such as Vivo and Oppo.

According to shipment data for the second quarter of the Indian smartphone market released recently by market research firm Canalys, Samsung Electronics holds a 17% market share. While the gap between first-place Xiaomi (29%) and Samsung Electronics is 12 percentage points, the difference with third-place Vivo (17%) is almost negligible. The shipment difference between Samsung Electronics (5.5 million units) and Vivo (5.4 million units) is only about 100,000 units. Following them are Chinese companies Realme (15%) and Oppo (12%) in fourth and fifth place, respectively. Among the top five, four companies excluding Samsung Electronics are all Chinese manufacturers leading with low-price strategies.

The Indian smartphone market, which was hit hard by the resurgence of COVID-19, is expected to rebound in the second half of this year due to vaccine rollouts and new product launches. However, strong pent-up demand like last year is unlikely. Concerns about the resurgence of COVID-19 remain, and deteriorating macroeconomic conditions, parts supply shortages, and rising shipping costs are expected to negatively impact the overall market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.