Record High IPO Order Amounts Gathered

Expectations for Smooth Sailing Amid Challenges Ahead

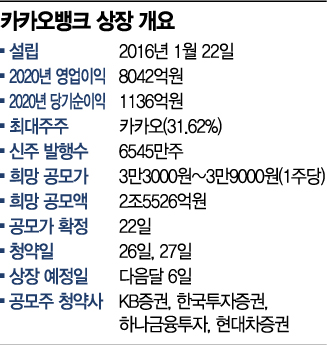

[Asia Economy Reporter Seong Giho] The initial public offering (IPO) market's biggest player, KakaoBank, began its general public subscription on the 26th. Despite receiving the highest-ever order amount in the institutional demand forecast, attracting intense interest, there are still many hurdles to overcome. Industry experts point out that expanding loans and differentiating from KakaoPay remain ongoing challenges.

According to financial authorities, KakaoBank started its public subscription for general investors from the 26th to the 27th. KakaoBank received subscription orders totaling 2,585 trillion won during the institutional demand forecast held on the 20th and 21st, the highest amount ever in an IPO, leading to expectations of a smooth public subscription. The previous record was 2,417 trillion won by SK IE Technology (SKIET). The subscription competition rate was also 1,732.83 to 1, ranking second highest in KOSPI history.

Although the atmosphere is heated ahead of the IPO, the market believes that KakaoBank faces numerous challenges to increase its corporate value not only immediately after listing but also in the future. The foremost issue is the loan sector, the key to KakaoBank's growth. KakaoBank announced that it will use the funds raised through the listing as loan capital. In line with government policies, more than 1.5 trillion won of the newly raised funds will be allocated to expanding loans for low- to medium-credit borrowers and various products such as mortgage loans.

However, the market predicts that once the expansion of mid-interest loans, the core mission of internet-only banks, begins in earnest, KakaoBank may find it difficult to maintain its current upward momentum.

Park Seonji, senior researcher at NICE Credit Rating, pointed out that as of the end of last year, the proportion of mid- to low-credit loans (KCB grades 4?10) for KakaoBank and K Bank was 12.1%, which is low compared to the overall banking sector's 24.2%. She analyzed, "There are concerns about the deterioration of profitability and soundness for internet banks tasked with expanding mid- to low-credit loans under the financial authorities' recommendations."

Differentiation from KakaoPay, which has a similar listing schedule, is also a challenge. At the IPO press conference, KakaoBank revealed a blueprint to enter the insurance and securities markets to maintain future growth. However, KakaoPay has already entered these sectors.

Some believe that for KakaoBank to grow, competition with its sibling under the same roof is inevitable. At the IPO press conference, CEO Yoon Ho-young did not provide a clear answer regarding the relationship with KakaoPay when asked.

A financial industry official commented, "KakaoBank mentioning the growth potential of another financial company within the same corporate group indicates the difficulty in finding highly growth-oriented markets. If the two companies enter into competition, a price war is inevitable, making this a continuous challenge going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.