Record High Transactions of Commercial and Office Buildings in the First Half of the Year

Small Buildings Relatively Affordable, Lowering Entry Barriers

Suitable for Investment with Small-Scale Remodeling Possible

Gangnam-gu Tops Transaction Volume... Mapo Shows Increasing Growth Rate

[Asia Economy Reporter Ryu Tae-min] Commercial and office real estate is benefiting from the government's successive high-intensity regulations on housing transactions. In particular, old small buildings that are not only newly constructed but also remodelable are gaining attention as a new investment destination for cash-rich investors.

According to the market report published on the 26th by Proptech company Real Estate Planet, the number of commercial and office building transactions in Seoul in the first half of this year reached 2,036. This is an increase of 602 transactions (41.9%) compared to 1,434 transactions in the same period last year. The transaction amount was 18.4 trillion KRW, nearly double the 9.9 trillion KRW from the same period last year. Since the Ministry of Land, Infrastructure and Transport began disclosing actual transaction prices in 2006, both transaction volume and amount for the first half of the year are at their highest levels.

The surge in commercial and office building transactions is interpreted as a balloon effect caused by housing market regulations. Professor Seo Jin-hyung of Gyeongin Women's University (President of the Korea Real Estate Society) explained, "As the loan and tax burden on high-priced housing increases, abundant liquidity in the market is flowing into the building market, which is considered a safe asset."

Most of the buildings traded in the first half were small-scale ‘kkoma buildings’ (small buildings). Transactions of buildings with a total floor area of 100 to 3,000㎡ totaled 1,535, accounting for 75.4% of all transactions. The transaction amount also increased by 79% compared to the same period last year, reaching 10.6 trillion KRW.

Kkoma buildings have relatively low prices, making the investment entry barrier low, and they can be remodeled with a small amount of money, emerging as a new investment destination for cash-rich investors. In fact, the number of commercial and office building transactions in the 1 to 10 billion KRW range in the first half was 1,355, accounting for more than 60% of all transactions.

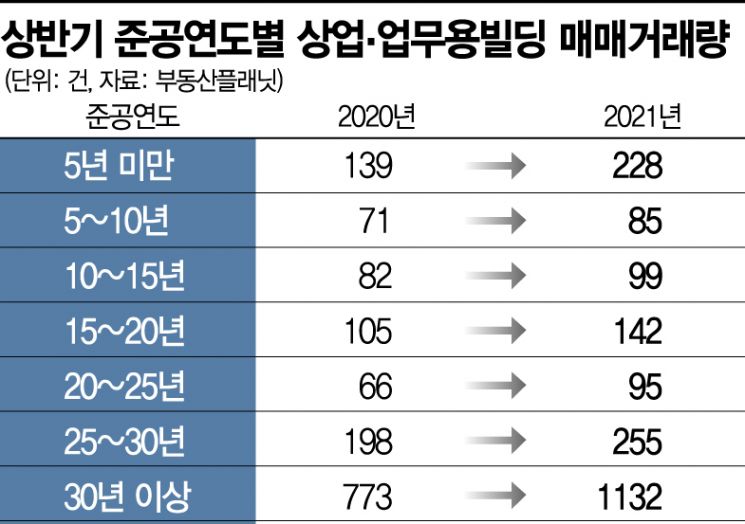

Another notable feature is the increase in transactions of old buildings. By year of completion, the number of transactions for buildings over 30 years old was 1,132, a 46.4% increase from 773 in the same period last year. This means that 55.5% of the total transactions were for old kkoma buildings. Transactions for buildings between 25 and 30 years old also reached 255, followed by 228 for buildings under 5 years, 142 for 15 to 20 years, and 99 for 10 to 15 years. Experts analyze that the high volume of old building transactions is due to increased investment demand to remodel or reconstruct buildings to increase their value as rental income has decreased due to COVID-19 and other factors.

Meanwhile, by district, Gangnam-gu had the highest number of building transactions with 244. Transactions were prominent in major commercial areas such as Nonhyeon-dong (59), Sinsa-dong (55), and Yeoksam-dong (52). This was followed by Jongno-gu (179) and Mapo-gu (172). Mapo-gu had the highest growth rate in transaction volume among Seoul’s 25 districts, increasing by 224.5% compared to the same period last year. Professor Seo explained, "Buildings in the Gangnam area are popular because land price appreciation rates are high, commercial districts have been established for a long time, there is strong demand for sales, and future handling is easy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.