Bank of Korea 'Overseas Economic Focus'

[Asia Economy Reporter Kim Eunbyeol] The Bank of Korea evaluated that global investment will continue its favorable trend for the time being, supported by major countries' expanded fiscal spending and companies' favorable financing conditions. It is expected that global investment will maintain its positive momentum, accelerating the pace of global economic improvement alongside consumption recovery. While new technologies and green investments will attract attention in the future, they are unlikely to drive global investment over the long term.

On the 25th, the Bank of Korea stated in its 'Overseas Economic Focus' report, "Recently, global investment has increased significantly, and expectations are spreading that investment expansion, along with consumption recovery, will lead the global economy going forward." As global economic recovery progresses and companies expand facilities, capital goods orders have surged sharply, but opinions are divided on whether this is a temporary phenomenon due to economic recovery or the beginning of a new investment boom.

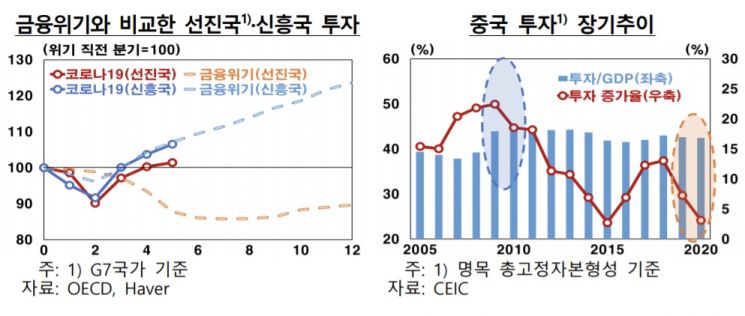

The Bank of Korea said, "Recently, global investment has been rapidly expanding in both advanced and emerging countries," adding, "Advanced countries, led by the United States, have recovered to pre-pandemic levels within about a year, and the somewhat sluggish Eurozone and Japan also resumed recovery trends in the second quarter."

Regarding emerging countries, it explained that although China's investment growth slowed due to a consumption-centered growth strategy, rapid increases were observed mainly in Brazil and India. This was due to export growth driven by increased goods consumption in advanced countries despite domestic demand weakness.

Looking at overall investment conditions going forward, the global economy is expected to continue improving due to major countries' fiscal expansion and normalization of economic activities. The Bank of Korea stated, "Companies' financing conditions also remain favorable due to a low-interest-rate environment and increased operating profits." However, it noted that there is an inherent possibility that investment expansion could be constrained by uncertainties regarding the direction of global growth.

Regarding investment in new technologies, it is expected to lead global investment, but the growth rate will gradually slow after a significant expansion," the report forecasted. While the acceleration of the transition to a digital economy and progress in the Fourth Industrial Revolution will support the favorable trend for the time being, factors such as declining investment returns due to supply expansion may act as constraints.

Regarding green investment, which has recently gained attention amid the rise of the eco-friendly economy, the report stated, "Because it largely replaces investments in fossil energy, the overall effect on investment expansion is considered limited." Concerning recent supply chain bottlenecks in some raw materials and components, it forecasted, "Although investment in these items will increase, considering that overall facility operating rates remain low, it will be difficult for this to become a factor driving global investment growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.