[Asia Economy Reporter Kwangho Lee] The one-year fixed deposit interest rate at domestic savings banks has risen to the 2% range.

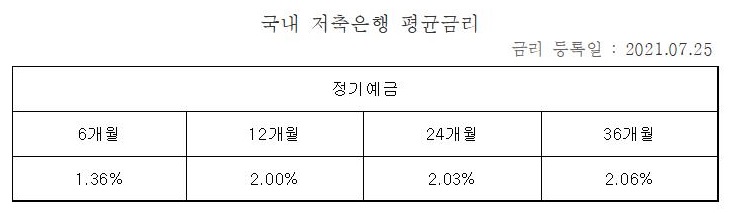

According to the Korea Federation of Savings Banks on the 25th, as of the 23rd, the average interest rate for one-year fixed deposits at savings banks is 2.0% per annum.

It had fallen to 1.61% per annum at the end of April but rose by 0.39 percentage points in three months, recovering to the 2.0% range again.

The two-year term is 2.03% per annum, and the three-year term is 2.06% per annum.

By savings bank, SangSangIn Savings Bank offers a non-face-to-face fixed deposit with a preferential interest rate of 2.51% per annum for both one-year and two-year terms without any special conditions.

Also, Kiwoom YES Savings Bank offers 2.50% per annum for one-year terms, and MS Savings Bank offers 2.45%. The highest three-year term interest rate is at Aequan Savings Bank, at 2.65% per annum.

Savings banks are competing for deposits because financial authorities have announced 'targeted regulations' on the increase in loans from the secondary financial sector.

Last week, the financial authorities summoned representatives from savings banks, insurance companies, specialized credit finance companies, and mutual finance companies for meetings and requested strengthening household loan management.

At the meeting, the financial authorities urged each company to comply with their set household loan growth targets and warned that if not followed, household loan regulations could be tightened in the secondary financial sector as well.

The targeted household loan growth rate set by the financial authorities is 5-6% annually this year and around 4% next year. To achieve this, regulations have been strengthened mainly on banks with large loan volumes. The secondary financial sector has enjoyed relatively lax regulatory effects, expanded operations, and increased household loans excessively, according to the financial authorities' perspective.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.