Monthly payment burden decreases...

The longer the repayment period, the larger the total interest repayment amount in the total repayment sum becomes

[Asia Economy Reporter Park Sun-mi] As a 40-year maturity mortgage (Bogeumjari Loan·Qualified Loan) product was launched this month, advice has been raised that it is necessary to resolve potential consumer disputes through accurate information provision, such as the increase in total repayment burden.

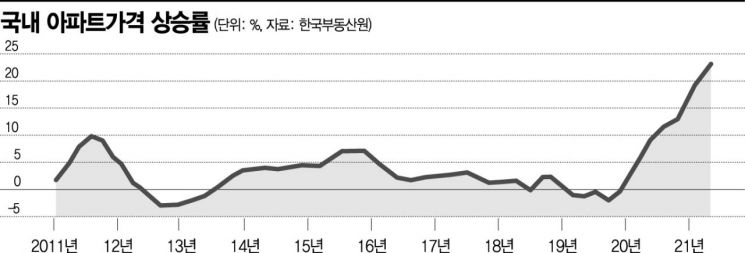

On the 24th, the Korea Institute of Finance explained in its report titled "Introduction of 40-year Maturity Mortgage Products and Future Policy Tasks" that "the extension of mortgage maturities is observed in other countries such as Europe due to the global trend of rising housing prices," adding, "Since mortgage loan principals are large, repayment periods are often long, and governments in various countries often intervene directly or indirectly to support this policy-wise."

In Korea, from July this year, 40-year maturity Bogeumjari Loan and Qualified Loan were pilot-launched for policy purposes to reduce the monthly repayment burden of housing mortgage loans. This product extends the maturity of policy mortgages, which currently have a maximum of 30 years, by 10 years to reduce the monthly principal and interest repayment burden.

The 40-year maturity policy mortgage targets youth under 39 years old and newlyweds within 7 years of marriage. It applies the Bogeumjari Loan requirements (house price of 600 million KRW, income of 70 million KRW). The policy authorities estimate that for a 300 million KRW loan at a fixed interest rate of 2.85% with a 30-year maturity, the monthly repayment amount is 1,241,000 KRW, but if converted to a 40-year maturity at a fixed interest rate of 2.90%, the monthly repayment amount decreases by 14.8% to 1,057,000 KRW.

Senior Research Fellow Kim Young-do said, "When offering ultra-long-term mortgage products, it is necessary to clearly convey relevant information that may influence consumer choices," explaining, "Although the monthly payment burden may decrease, the longer the repayment period, the larger the total interest repayment amount in the total repayment. Also, generally, as the repayment period lengthens, the monthly repayment amount in the early stages consists more of interest repayment than principal repayment."

For example, in the case of consumers who prepay a 40-year mortgage after 7 years, even if they consistently repay monthly for about 7 years, the unpaid mortgage principal remains relatively large compared to a 30-year mortgage, increasing the burden of prepayment. Because the repayment period is long, there is also the issue that repayment burdens may remain at retirement.

He added, "By clearly providing such information, it is necessary to resolve information asymmetry among consumers and prevent potential consumer disputes that may arise with ultra-long-term mortgage products," and "Also, in the case of Bogeumjari Loan and Qualified Loan, there are price limits on collateral housing of 600 million KRW and 900 million KRW respectively, but considering the recent sharp rise in apartment prices, there are opinions that the eligible housing is too limited."

He advised, "Furthermore, providing ultra-long-term fixed-rate products ultimately means that the provider must bear the interest rate fluctuation risk that may occur in the future, so institutions offering ultra-long-term mortgage products need to thoroughly manage mid- to long-term risks," adding, "Regarding product design, it is also necessary to additionally consider offering products designed so that mortgage repayment ends before retirement age, while providing ultra-long-term mortgages with low monthly repayment burdens like the 40-year mortgage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)