Heated 'Basic Income Debate' Rekindled

Cost-Effectiveness Controversy, Rent Transfer, Funding Specificity

What Do You Think About the Anti-Basic Income Debate?

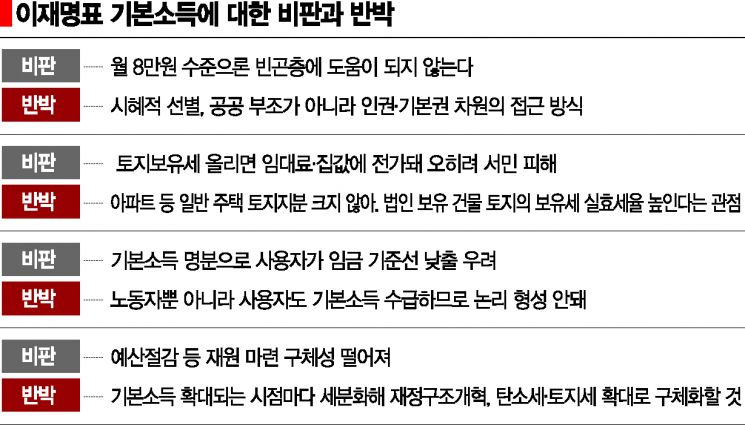

[Asia Economy Reporter Koo Chae-eun] Criticisms of Gyeonggi Governor Lee Jae-myung’s ‘Basic Income Policy Pledge’ announced on the 22nd can be summarized into four main points.

First, the ‘cost-effectiveness controversy’ that claims 52 trillion won of taxpayers’ money is wasted to give 80,000 won per month (1 million won annually per person nationwide). Second, the criticism that imposing a land tax as a source of basic income funding could be ‘passed on to ordinary citizens through higher housing prices and rents.’ Third, the concern that employers might use basic income as a pretext to reduce daily wages or allowances. Fourth, the lack of specificity in securing funding. In response to these criticisms, we asked Lee Han-joo, director of the Gyeonggi Research Institute and known as the ‘policy brain’ and planner of the basic income, for counterarguments.

① Only 80,000 won per month = Even if 1 million won per person nationwide and 2 million won for youth are completed within the next presidential term, the monthly payment amounts to only 80,000 won and 160,000 won respectively. This is why it is criticized as pocket money rather than income. Director Lee pointed out that the intangible effects of basic income as a ‘basic right’ are important.

Director Lee said, “Since it is not a concept of charity or relief based on ‘because you are poor, take this,’ tailored support can be provided to low-income groups, and for citizens with a certain level of income or higher, it can increase tax trust and the sense of efficacy in paying taxes.” He added that starting with a small amount is inevitable due to funding issues but emphasized that the effect of revitalizing the local economy is also clear.

② Land holding tax as funding? Passed on to rent and housing prices = There is also criticism that imposing a land tax could be passed on as rent or housing price increases and that it could result in double taxation with existing comprehensive real estate tax and property tax. Director Lee explained, “General houses such as apartments have a low land share, so the tax rate will not be high, and mainly corporate-owned land or large land parcels will be targeted.” He explained that the tax burden on general houses will not be significant.

He added, “It will be necessary to extract and adjust the land portion of each tax item to avoid overlapping taxation with comprehensive real estate tax or property tax.” In particular, Director Lee mentioned the expected effect that “fundamentally increasing the burden of ‘holding tax’ can create resistance to realizing gains through land.”

③ Basic income as a pretext to lower allowances and daily wages? = Regarding the criticism that employers might misuse basic income as a pretext to reduce daily wages and allowances during wage negotiations, he said, “Basic income raises the living expenses not only of employees but also of employers, so the basis for criticism falls apart.”

④ Lack of specificity in securing funding = Governor Lee subdivided the funding plans according to the timing of basic income expansion. In the short term, when 250,000 won is paid annually, 25 trillion won can be secured through fiscal structure reform, budget cuts, and budget prioritization. When the payment amount expands, an additional 25 trillion won will be secured from tax reductions and exemptions totaling 60 trillion won annually.

In the long term, he said that basic income land tax and basic income carbon tax will be imposed as funding sources. Regarding criticism that there is a lack of specificity about which budget areas will be cut, he said, “A pledge states a direction. Just as there is a blueprint and detailed design when constructing a building, the details will be further refined through discussions.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.