Lee Hak-young and 10 Members of the Democratic Party

Propose Bill to Apply Preferential Fee Rates for Social Enterprises

Political Circle Proposes 5 Card Fee Bills in One Year Since Last Year

Industry: "Fees Already at Cost Level, No Room to Lower"

[Asia Economy Reporter Ki Ha-young] Ahead of the recalculation of franchise commission rates in the second half of this year, bills related to franchise commissions are being proposed one after another. Since June last year, five related bills have been proposed within a year, focusing on additional reductions in card commission rates or expanding the scope of preferential commission rates. Card companies are already protesting, saying that commission revenue is at cost level and there is no room for further reduction.

According to the National Assembly and the card industry on the 23rd, Lee Hak-young, a member of the Democratic Party of Korea, and 10 others recently proposed a partial amendment to the "Specialized Credit Finance Business Act" to apply a separate preferential commission rate to social enterprises below a scale prescribed by presidential decree. Social enterprises are engaged in public interest projects with a strong public nature, such as providing social services or jobs to vulnerable groups, and unlike for-profit companies, they find it difficult to pursue profits. Despite this, they bear excessive credit card franchise commissions, which is said to be a major factor in worsening management.

This bill was also proposed in 2018. At that time, it was scrapped due to concerns about fairness issues with other franchises if a separate preferential commission rate was applied only to social enterprises. It was argued that support for social enterprises is more appropriate to be provided through financial support from the state or local governments rather than private burdens such as card companies.

An industry official said, "In principle, it is right to apply commissions based on eligible costs under the Specialized Credit Finance Business Act even to social enterprises," adding, "Proposing separate commission benefits for social enterprises is likely to raise fairness issues and ultimately means returning to the industry-specific commission system before the introduction of the eligible cost system."

As the recalculation of franchise commissions approaches this year, the political circle is rapidly proposing bills related to commissions. In June last year, Koo Ja-geun of the People Power Party and 11 others proposed an amendment to the Specialized Credit Finance Business Act, focusing on exemption from commissions for small payments under 10,000 won and applying preferential commission rates to traditional markets. Subsequently, lawmakers Song Eon-seok, Lee Yong-ho, Hong Sung-guk of the Democratic Party, and Lee Hak-young also introduced bills related to card commissions. These bills aim to support small business owners and micro-entrepreneurs who have been struggling due to COVID-19.

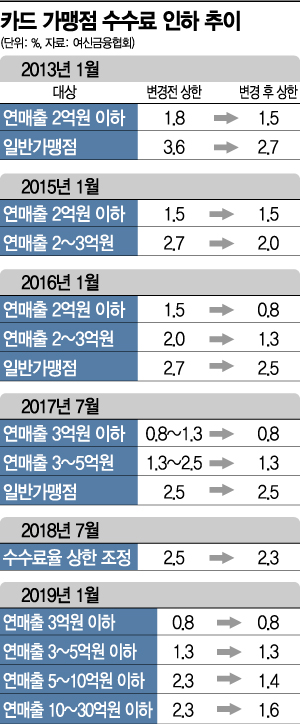

The card industry is already anxious about whether the franchise commission rate, which is at cost level, will be further reduced this year. The card franchise commission rate has been reduced 13 times over 12 years from 2007 to 2019. In particular, in 2018, the scope of preferential franchises was expanded from those with sales under 500 million won to those under 3 billion won, increasing the proportion of preferential franchises from 84% to 96% of all franchises. The card industry explains that considering tax benefits, franchises with annual sales under 1 billion won effectively have commission rates in the 0% range. Another industry official expressed concern, saying, "With reduced operating and marketing costs due to COVID-19, performance is not bad, but we worry that even this might be used as a justification for commission rate cuts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.