Linked to Wheat Raw Material with One-Year Lag

Reflecting Next Year's Soaring Raw Material Costs

Record-High Increase Expected After 8 Years of Freeze

[Asia Economy Reporter Seungjin Lee] As international wheat prices rise to levels similar to those during the 2012 global grain crisis, leading to price hikes in the confectionery, bakery, and ramen industries, the milling industry is also deeply concerned about increasing flour prices.

On the 23rd, CJ CheilJedang and Daehan Flour Milling, the top two domestic milling companies, stated that "we are closely monitoring the sharp rise in international wheat prices." Since raising prices by about 8% in January 2013, both companies have kept flour prices frozen. The reason flour prices remain unchanged despite daily price increases by processed food companies is that the prices of raw wheat and processed flour are linked with a one-year time lag.

A food industry official explained, "Wheat contracts are made on an annual basis, so the sharp price increase this year has not yet been reflected in manufacturing costs. However, since the soaring raw material prices will be reflected next year, it seems difficult to avoid flour price hikes, and some companies have already raised prices earlier this year."

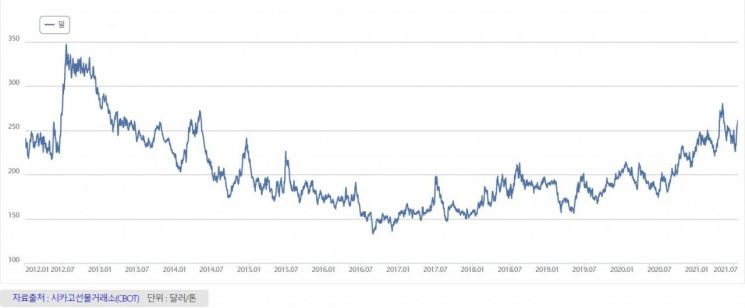

According to the Chicago Mercantile Exchange, international wheat prices surged to $276 per ton during the 2012 global grain crisis and then steadily declined. Prices fell to $160 in 2016 and remained around $180 until 2019. Due to the drop in raw material prices, the milling industry was able to maintain prices despite rising labor and other costs. The problem lies in next year. Having frozen prices for the past eight years, the increase could reach an all-time high.

The burden of rising raw material prices on the food industry continues to grow and is expected to affect ramen price hikes as well. Ottogi recently decided to raise ramen prices by an average of 11.9% starting in August, citing rising raw material costs such as cooking oil. Nongshim and Samyang Foods are also reviewing whether to raise ramen prices and are expected to determine the extent of the increase based on the milling industry's moves.

A food industry official forecasted, "Due to the time lag between futures and spot prices, ingredients that have maintained stable prices are expected to rise significantly as early as the second half of this year or by next year at the latest, making next year's inflation rate steeper."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.