Capital Region Records Highest Jeonse Price Increase Rate in 8 Months

But Bundang Declines... Sejong Also Falls Among Regulated Areas

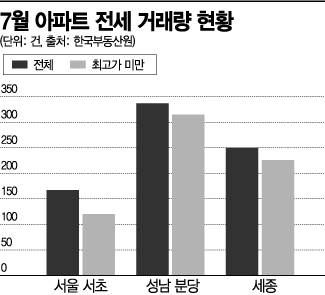

In July Transactions, 93% in Bundang and 90% in Sejong Below Highest Price

Impact of Abundant Housing Supply This Year

[Asia Economy Reporter Onyu Lim] While nationwide jeonse prices continue to soar, only Bundang-gu in Seongnam-si, Gyeonggi Province, and Sejong City among regulated areas have seen jeonse prices decline, drawing attention to the reasons behind this trend. In these areas, where recent housing supply has increased, it was analyzed that fewer than 1 in 10 contracts in July were at record or highest prices. The consensus is that the solution to the jeonse shortage ultimately lies in 'supply.'

According to the Korea Real Estate Board on the 23rd, among nationwide regulated areas, Bundang and Sejong were the only two places where apartment jeonse prices fell in the third week of this month. Bundang's jeonse prices have declined for three consecutive weeks since the third week of June.

Although prices briefly rebounded in the second week of this month, they fell again by 0.12% in the third week. This is in stark contrast to the Seoul metropolitan area's apartment jeonse price increase rate, which recorded its highest in eight months at 0.25% since the fourth week of November last year. Jeonse prices in Sejong, which had surged due to the 'administrative capital relocation theory,' also fell by 0.03% in the third week of July, continuing a 14-week consecutive decline.

The stabilized jeonse market atmosphere in these two areas is also reflected in actual transaction statistics. Asia Economy analyzed all jeonse transactions in Bundang and Sejong in July and found that transactions at record or highest prices accounted for less than 1 in 10 cases. In Bundang, 315 out of 337 transactions (93%) were conducted at prices lower than the highest price, and in Sejong, 226 out of 250 transactions (90%) were below the highest price. Even considering many renewal contracts bound by the 5% rent cap, these figures are high compared to other regions. In Seocho-gu, Seoul, where jeonse prices are rising due to a surge in relocation demand from recent reconstruction, only 120 out of 167 transactions (72%) were below the highest price, showing about a 20 percentage point difference from Bundang and Sejong.

The real estate industry analyzes that the decline in jeonse prices in Bundang and Sejong stems from the effect of large-scale supply. The housing supply in Bundang-gu was abundant with △2,215 households in May and △1,221 households in June. As the Daejang district's move-in phase began in earnest, jeonse listings increased significantly. According to the real estate big data company Apartment Real Transactions, jeonse listings in Bundang rose by more than 44%, from 1,311 in January to 1,890. Sejong also saw this year's housing supply reach 7,600 households, double that of last year.

Experts believe that expanding supply is inevitable to resolve the jeonse shortage that has spread mainly in the Seoul metropolitan area. Since large-scale land development or redevelopment and reconstruction projects take a long time, it is necessary to increase short-term supply by improving various regulations that distort the market, such as the new lease protection law.

In fact, when the two-year mandatory residence requirement for reconstruction association members was withdrawn, jeonse listings in major complexes such as Eunma in Gangnam-gu, Seoul, and Seongsan Sigyeong in Mapo-gu more than doubled. Professor Daejung Kwon of Myongji University's Department of Real Estate said, "Since the implementation of the new lease law, jeonse listings have further decreased, causing a shortage, and rent has surged, leading to many conflicts between landlords and tenants," adding, "The government should consider a major revision of the law even now."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.