Moderna Stock Triples This Year Surpassing $300... 73% of Wall Street Analysts Predict Future Decline

[Asia Economy Reporter Byunghee Park] Moderna, the COVID-19 vaccine manufacturer, was included in the New York Stock Exchange's S&P 500 index on the 21st (local time), replacing the top-performing stock in the S&P 500 index this year.

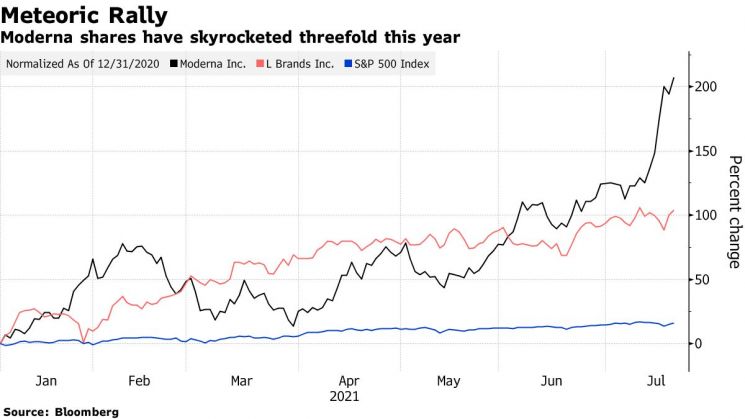

According to Bloomberg News, before Moderna's inclusion, the highest-performing stock in the S&P 500 index this year was Limited Brands. Limited Brands' stock price rose 104% this year. However, with Moderna's inclusion, Limited Brands was pushed to second place.

Moderna's stock price has risen 207% this year. At the end of last year, Moderna's stock price was $104.47, and it now easily exceeds $300.

With the positive effect of being included in the S&P 500 index, Moderna's stock price surged 30% in just four trading days until the 19th, quickly surpassing $300. Although it hesitated on the 20th due to the burden from the rapid rise, it surged again by 4.5% on the 21st, setting a new all-time high. The closing price was $321.11, and the market capitalization grew to $129 billion.

On Wall Street, Moderna is being called the Tesla of the biotech industry, as it could change the way infectious diseases are treated.

Moderna's COVID-19 vaccine was developed using 'messenger ribonucleic acid' (mRNA), which contains the virus's genetic information. The fact that this is the first time an mRNA-based vaccine has been commercialized is why Moderna is compared to Tesla, which pioneered the electric vehicle market.

However, Bloomberg analyzed that stock prices generally underperformed after inclusion in the S&P 500 index. Tesla, for example, was included in the S&P 500 index in December last year, and its stock price has fallen about 6% this year, showing a sluggish trend. The S&P 500 index has risen about 18% this year.

There are also considerable expectations that Moderna will experience fluctuations following its rapid rise. In a survey conducted by investment bank Jefferies targeting 191 hedge funds and institutional investors, 73% expected Moderna's stock price to remain largely unchanged or even fall by 20% from the current level by the end of this year. Only 13% anticipated further increases.

Goldman Sachs highly evaluated Moderna's long-term growth potential. Goldman Sachs predicted that Moderna could release a new flu treatment by 2023 and possibly launch a vaccine that treats both COVID-19 and the flu simultaneously as early as 2024. Moderna is also known to be developing vaccines related to AIDS, Zika virus, cancer, and heart disease.

However, Goldman Sachs set Moderna's target stock price at $299. Goldman Sachs expects Moderna's COVID-19 vaccine sales this year to exceed Wall Street's forecast of $18.1 billion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)