Recovery Trend in Gold Savings Accounts Seen in June Amid Prolonged COVID-19 and Cryptocurrency Slowdown

[Asia Economy reporters Kiho Sung and Jinho Kim] Gold-related products are gaining popularity amid the spread of the COVID-19 Delta variant and the sharp decline in cryptocurrencies. In particular, the MZ generation in their 20s and 30s, exhausted by soaring housing prices beyond what their existing income can handle and the high volatility of stocks and coins, are expanding their investment methods to include gold, a safe asset, mobilizing all available investment options.

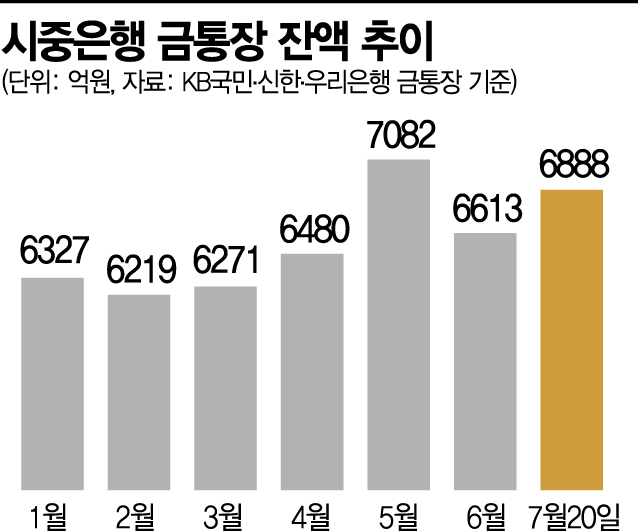

According to the financial industry on the 22nd, as of the 20th, the balance of gold accounts at KB Kookmin, Shinhan, and Woori Banks reached 688.8 billion KRW, an increase of 27.5 billion KRW from the previous month (661.3 billion KRW). The gold account balance had slightly decreased from 632.7 billion KRW in January to 621.9 billion KRW in February but then increased until May (708.2 billion KRW). However, in June, after the U.S. Federal Reserve announced plans to raise interest rates twice by 2023, the gold account balance decreased again in June (661.3 billion KRW). Typically, when U.S. interest rates rise, the dollar strengthens, causing gold prices to lose popularity.

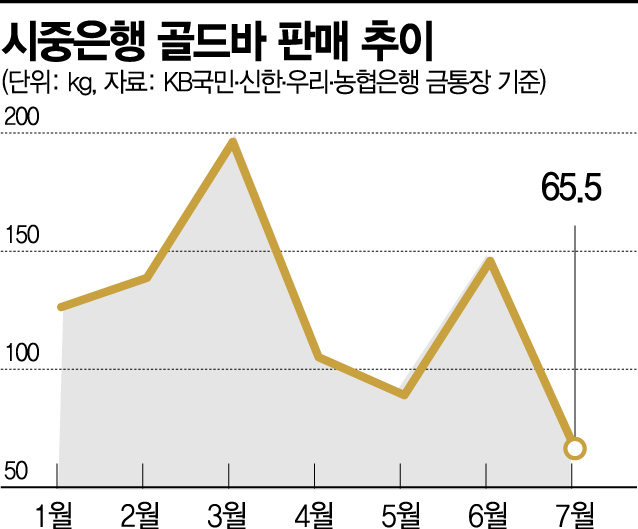

However, with gold prices recovering this month, the popularity of gold accounts is rising again. According to the Korea Gold Exchange, the gold price, which was 278,000 KRW per 3.75g on June 30, rose to 290,500 KRW on the 20th. The gold price also affected sales of gold bars, which are sensitive to price changes. According to KB Kookmin, Hana, Woori, and NH Nonghyup Banks, as of the 16th, gold bar sales for July were 65.5 kg. Gold bar sales, which had sharply declined from 105.1 kg in April to 89 kg in May, surged to 145.9 kg in June when prices were lower.

The renewed popularity of gold as a safe asset is due to the global spread of the COVID-19 Delta variant, which has cast doubt on a swift economic recovery, and the recent sharp decline in cryptocurrencies that had been in the spotlight.

Cryptocurrencies, which had sparked a frenzy with the slogan "Avoid becoming a sudden pauper," have seen prices of most coins plummet nearly 50% over the past two months. According to Upbit, South Korea's largest cryptocurrency exchange, only one out of 102 coins increased in price over the past three months. Meanwhile, the stock market continues to face ongoing debates about its high valuations.

As a result, gold investment has begun to attract attention as a good investment option that offers both "stability and profitability," especially among the MZ generation. Facing the burden of investing in highly volatile cryptocurrencies and a stock market that keeps hitting new highs, they are turning their eyes to gold, a "safe asset."

In fact, according to the Korea Exchange, as of March this year, 51.8% of individual investors who opened general product accounts at securities firms to trade in the KRX (Korea Exchange) gold market were in their 20s and 30s. With the active participation of the MZ generation in gold investment, the market size is rapidly growing. The average daily trading value in the first half of this year was 8.26 billion KRW, up 13.8% from the previous year. The average daily trading volume also increased by 19.4% to 126.2 kg during the same period.

The reason the MZ generation focuses on gold investment is due to its "low transaction costs." The KRX gold market imposes no taxes on capital gains and exempts value-added tax on on-exchange transactions. Transaction fees are also lower compared to general investment products.

A Korea Exchange official said, "With the expansion of global economic uncertainty, the importance of safe assets has been highlighted, and gold is gaining attention," adding, "The rapid growth of the gold market is due to increased participation by young investors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)