KOSPI 200 and Large-Mid Cap Stocks... KOSDAQ Focuses on Bio and IT

Attention Needed on 'Net Sold Stocks' Mechanically Sold by Pension Funds

[Asia Economy Reporter Lee Seon-ae] The National Pension Service (NPS), a major player in the domestic stock market, is planning to revamp its benchmark (BM) by adding 50 stocks each to the KOSPI and KOSDAQ markets, drawing investors' attention to the related beneficiary stocks.

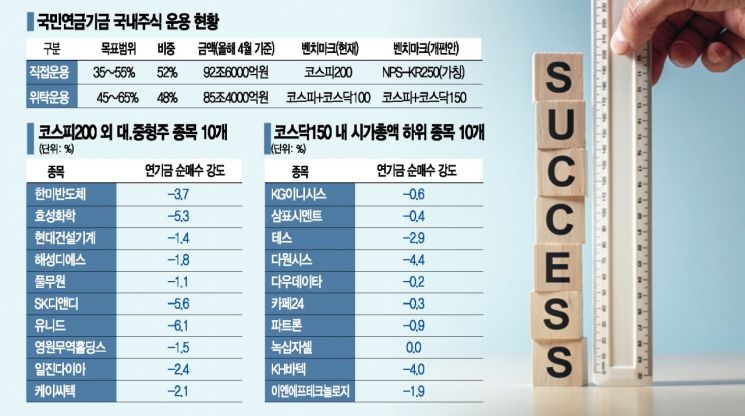

The securities industry is deeply engaged in finding beneficiary stocks likely to be included in the NPS's stock portfolio. The NPS fund's stock management is divided into direct management and entrusted management, with current proportions of 52% and 48%, respectively. The benchmark for direct management is the 'KOSPI 200,' while the benchmark for entrusted management is 'KOSPI + KOSDAQ 100.'

According to the financial investment industry on the 22nd, the NPS Fund Management Headquarters is promoting a plan to add 50 KOSPI stocks to the direct management benchmark and 50 KOSDAQ stocks to the entrusted management benchmark to improve efficiency amid the increase in the scale of domestic stock assets under management. Accordingly, direct management will use the 'NPS-KR250 (tentative name),' which adds 50 KOSPI stocks, and entrusted management will use 'KOSPI + KOSDAQ 150,' which adds 50 KOSDAQ stocks, expected to be applied from next year.

◆ Large and mid-cap KOSPI stocks... KOSDAQ bio and IT sectors 'promising' = Since inclusion in the NPS portfolio alone improves supply and demand, leading to significant stock price increases, investors are highly interested in stocks likely to receive the NPS's buying calls.

For direct management, large and mid-cap stocks not included in the KOSPI 200 index are expected to benefit. Among stocks not included in the KOSPI 200 but with high market capitalization are SD Biosensor, Macquarie Infrastructure, F&F, Hyundai AutoEver, Meritz Financial Group, Douzone Bizon, Meritz Fire & Marine Insurance, Genexine, Solus Advanced Materials, and Hanmi Semiconductor. Lee Jae-sun, a researcher at Hana Financial Investment, diagnosed, "The NPS tends to focus on large-cap stocks, so these stocks are likely to be positively affected in terms of supply and demand."

For entrusted management, stocks included in the KOSDAQ 150 index but not in the KOSDAQ 100 are expected to receive buying calls. Since the bio sector has the largest weight in KOSDAQ, bio stocks will primarily benefit, and considering industrial balance, IT-related stocks are generally seen as the next beneficiaries. Additionally, since the NPS recently announced it would consider ESG (Environmental, Social, and Governance) factors, it is recommended to exclude stocks with low ESG scores from the beneficiary list. Top market capitalization stocks in KOSDAQ include Celltrion Healthcare, Kakao Games, EcoPro BM, Pearl Abyss, Seegene, CJ ENM, SK Materials, Alteogen, and Hugel.

◆ Increased 'love calls' for stocks net sold by pension funds = There is also advice to pay attention to stocks net sold by pension funds, including the NPS. Choi Yoo-jun, a researcher at Shinhan Financial Investment, emphasized, "If the NPS, which has the largest asset size, undertakes a benchmark revamp, buying of mid-cap stocks that previously had little demand may increase. Among them, it is necessary to pay more attention to stocks that pension funds including the NPS have net sold this year." He added, "Within KOSPI, the target stocks are large and mid-cap stocks not included in the KOSPI 200 whose cumulative net buying intensity by pension funds in KOSPI 200 this year (-1.07%) is lower, and in KOSDAQ 150, stocks with lower market capitalization whose cumulative net buying intensity by pension funds in KOSDAQ 150 this year (0.02%) is lower."

In KOSPI, stocks such as Hanmi Semiconductor, Hyosung Chemical, Hyundai Construction Equipment, Haesung DS, Pulmuone, SK D&D, Unid, Youngone Holdings, Iljin Diamond, KC Tech, Korea Asset Trust, Kyobo Securities, LF, Yulchon Chemical, Korea Carbon, Halla Holdings, and Hyundai Energy Solutions are mentioned. Notably, Hanmi Semiconductor, which is expected to post its best performance this year, has not yet been included in the KOSPI 200. Pension funds have net sold about 52 billion KRW worth of Hanmi Semiconductor this year to maintain stock weight, and Hyosung Chemical and Hyundai Construction Equipment have been net sold by 51.1 billion KRW and 13.7 billion KRW, respectively.

KOSDAQ tends to have relatively higher stock price volatility due to pension fund supply and demand. Beneficiary stocks include KG Inicis, Sampyo Cement, TES, Dawonsys, Dow Data, Cafe24, Patron, Green Cross Cell, KH Vatech, ENF Technology, Seobu T&D, Koentec, Wonik Holdings, Ebest Investment & Securities, Telcon RF Pharmaceutical, Oisolution, Wonik Materials, Ubiquoss Holdings, Eugene Enterprise, Winix, Danawa, Dongkuk S&C, and Wiseol. Among these, Dawonsys (24.9 billion KRW), KH Vatech (19.4 billion KRW), and TES (18.4 billion KRW) have been net sold by pension funds by over 10 billion KRW each this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)