Limitations of Base Sales Only

Accelerating Changes in Workforce, Organization, and Sales Systems

[Asia Economy Reporter Kim Hyo-jin] As internet banks expand their reach and the financial industry landscape rapidly reshapes, regional banks are also accelerating their steps to secure new growth engines. This is due to a sense of crisis that survival cannot be guaranteed by the traditional method of managing profitability closely tied to the regional economy. The keyword for this movement is ‘digital’.

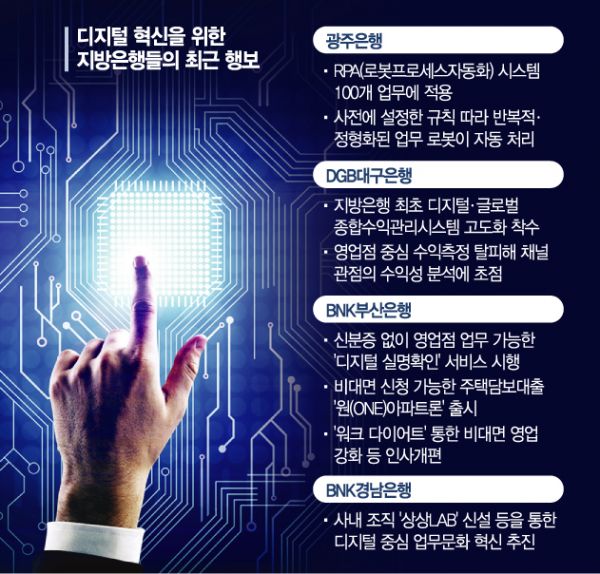

According to the banking sector on the 22nd, Gwangju Bank recently applied ‘Robotic Process Automation (RPA)’ to 100 tasks to improve work efficiency and enhance focus on core tasks. This is part of the company-wide initiative called ‘Digital Innovation Finance.’ The RPA system is a program that automatically processes repetitive and standardized simple tasks in a PC environment by applying pre-set rules to robot software. In an environment where competition in the financial sector is intensifying daily due to the entry of fintech (financial technology) companies and big tech (large information and communication companies) into the financial industry, the intention is to overcome regional limitations and lay the foundation for sustainable growth.

Gwangju Bank also became the first regional bank to obtain the full license for MyData (personal credit information management business). Song Jong-wook, president of Gwangju Bank, expressed his ambition, saying, "We will lead digital innovation and grow into a 100-year bank."

DGB Daegu Bank is accelerating efforts to build a foundation for innovation by expanding digital experts. They are publicly recruiting digital marketing planning and data analysis specialists until the 1st of next month. Additionally, last month, DGB Daegu Bank became the first regional bank to start upgrading its digital and global comprehensive revenue management system. As the digital platform IM Bank has begun to deliver tangible results, the need for profitability analysis considering the characteristics of non-face-to-face channels has increased. The new system focuses on providing profitability analysis results from a channel perspective, moving away from the traditional branch-centered profitability measurement method. DGB Daegu Bank expects to apply the new system as early as the beginning of 2023.

BNK Busan Bank has recently attracted attention with its digital real-name verification service. It allows existing customers to conduct transactions at branches without an ID card. Customers can scan a QR code available at the branch and authenticate themselves by logging into mobile banking to perform financial transactions. BNK Busan Bank also launched a new mortgage loan product called ‘ONE Apartment Loan,’ which can be applied for through the mobile banking application without visiting a branch.

Earlier this year, BNK Busan Bank implemented a ‘work diet’ targeting headquarters departments, establishing verbal reporting as the principle and abolishing or simplifying 11 committees and 478 reports. The personnel secured through the work diet were recently assigned in the regular personnel reshuffle to departments related to non-face-to-face outbound sales and new businesses, thereby further strengthening the internal innovation momentum. BNK Gyeongnam Bank is also striving to innovate its existing work culture by creating an in-house organization called ‘Sangsang LAB’ aimed at gathering creative ideas.

Efforts to expand beyond existing bases into the metropolitan area are also noticeable. DGB Daegu Bank, which recently opened a complex branch in Jung-gu, Seoul, plans to open another complex branch in Yeouido in the second half of this year.

BNK Financial Group opened the BNK Digital Center at the BNK Digital Tower in Gangnam-gu. This specialized organization was established to strengthen competitiveness in the digital sector, enhancing exchanges with digital experts and collaborating with fintech companies concentrated in Gangnam and Pangyo. A regional bank official said, "Digitalization of finance breaks down regional distinctions and limitations in business operations," adding, "It will be impossible to keep up with the flow of change by relying solely on the already established business base."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.