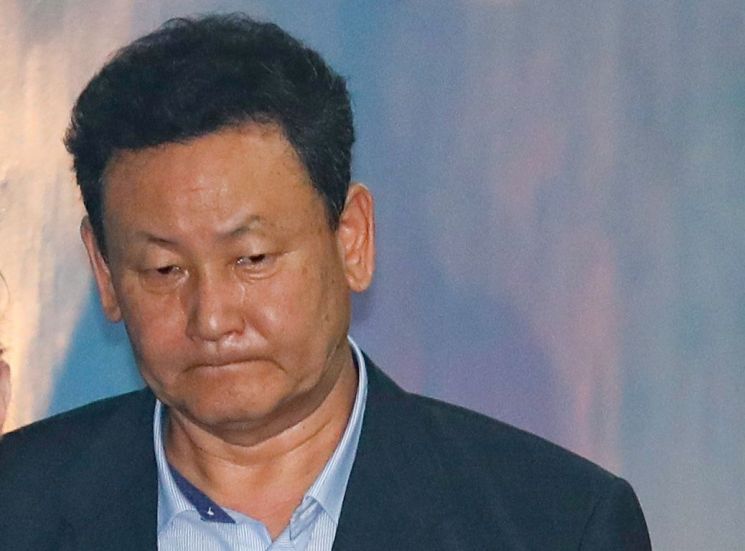

[Asia Economy Reporter Seongpil Cho] Lee Young-bae, CEO of Geumgang, known for managing former President Lee Myung-bak's nominee assets, filed a lawsuit requesting the cancellation of gift tax on 'MB nominee stocks' registered under his name but lost the case.

The Seoul Administrative Court, Administrative Division 8 (Presiding Judge Lee Jong-hwan) ruled against the plaintiffs, including CEO Lee, in the lawsuit filed against the Jamsil Tax Office chief seeking cancellation of the gift tax imposition. The court judged, "It is reasonable to consider that the nominee trust of the stocks was made under an agreement between former President Lee and the plaintiffs, and that such nominee trust had the purpose of tax evasion."

Earlier, the Seoul Regional Tax Office conducted a tax investigation on the assets of CEO Lee, his family, and university classmates from 2003 to 2016, concluding that the stocks they owned were nominee stocks of former President Lee. The respective tax offices imposed gift tax on CEO Lee and others for receiving the stocks from former President Lee in September 2003, and CEO Lee and others filed an administrative lawsuit contesting the taxation.

In court, CEO Lee and others argued that "it was not for tax evasion purposes" and claimed that "former President Lee, who was then the mayor of Seoul, established the trust to avoid political misunderstandings." However, the court rejected the argument, stating, "Former President Lee had the intention to evade various taxes by having a property manager handle slush funds and using nominee accounts for stock transactions as part of that," and dismissed the claims.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.