[Asia Economy Reporter Ji Yeon-jin] Concerns are rising that stock market volatility may increase as the Bank of Korea is expected to raise interest rates early next month.

According to the financial investment industry on the 18th, global central banks are shifting their monetary policies toward tightening. Emerging countries such as Brazil and Russia have already implemented three rounds of interest rate hikes, and advanced countries like Canada have begun tapering (reducing quantitative easing). New Zealand has decided to end quantitative easing and has announced an interest rate hike soon.

South Korea is also joining this trend. At this month's Monetary Policy Committee meeting, there was a minority opinion in favor of an interest rate hike, and Lee Ju-yeol, Governor of the Bank of Korea, expressed a relatively hawkish view. Because of this, the industry strongly expects an interest rate hike next month. Researcher Lee Mi-seon of Hana Financial Investment said, "The Monetary Policy Committee meeting was held under negative conditions with an average of about 1,000 new COVID-19 cases per day, but the Bank of Korea's economic outlook did not retreat," adding, "Considering the mention that the decision on adjusting monetary easing will be made at the next meeting, the August revised forecast is expected to raise this year's inflation outlook from 1.8% to around 2.0%, and many committee members expressed concerns about financial imbalances, the base rate in August is expected to be raised by 25 basis points to 0.75%." She also predicted that monetary policy would continue with an additional rate hike in October because it needs to have directionality rather than being a one-time measure to affect the real economy.

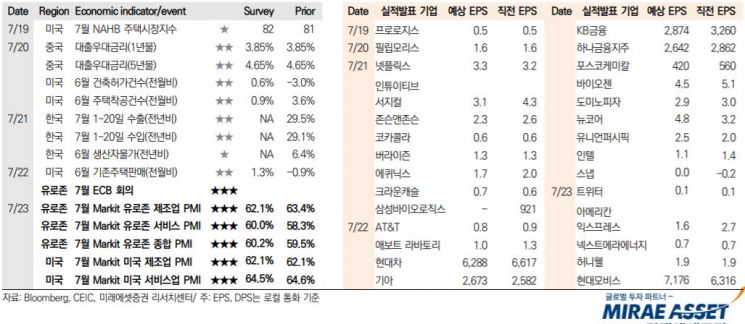

Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), has drawn a line on the possibility of policy changes, but market skepticism about the Fed's judgment of temporary inflation is growing. The recent surge in U.S. inflation significantly deviates from the Fed's previous forecasts. Park Hee-chan, a researcher at Mirae Asset Securities, said, "Within the Fed, there are quite a few voices advocating tapering within this year, so the risk of policy changes is not small. It is better to respond to stock investments from a neutral perspective," adding, "Corporate earnings during the earnings season are expected to be favorable, but the momentum peak-out controversy will limit the driving force for stock price increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.