Lawsuit for Return of Unpaid Immediate Annuity

Mirae Asset, Dongyang, Kyobo Lose First Trial

Attention on Samsung Life's First Trial Result Next Week

[Asia Economy Reporter Oh Hyung-gil] Insurance companies are becoming increasingly tense as they continue to lose in class-action lawsuits filed by consumers. Life insurers and non-life insurers are closely monitoring the results of ongoing lawsuits regarding the return of unpaid immediate annuity payments and refunds of automobile insurance deductibles, as these outcomes could have significant ripple effects on other related disputes.

According to the insurance industry on the 14th, the first trial verdict for a lawsuit filed by 57 policyholders, including Mr. Kang, against Samsung Life Insurance seeking the return of approximately 521.5 million KRW in immediate annuity insurance payments is expected on the 21st.

The reason this lawsuit, which began in October 2018 and has dragged on for over three years, is attracting attention is that Samsung Life has the largest amount of unpaid funds. According to the Financial Supervisory Service's 2018 assessment, the scale of unpaid immediate annuity funds reached 1 trillion KRW, with Samsung Life accounting for 430 billion KRW, Hanwha Life 85 billion KRW, and Kyobo Life 70 billion KRW.

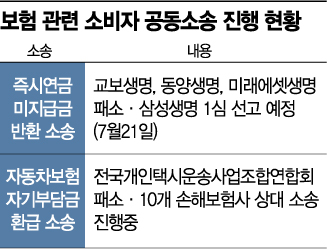

Another reason is that insurance companies have been losing consecutively in similar lawsuits. In the class-action lawsuit for the return of unpaid immediate annuity funds led by the Korea Financial Consumer Federation, Mirae Asset Life, Tongyang Life, and Kyobo Life all lost in the first trial. Although they appealed the rulings, if Samsung Life, the industry leader, also loses, it is expected to have a significant impact not only on other ongoing lawsuits but also on the appeals process, according to industry insiders.

Immediate annuities are products where a lump sum is paid as a premium, and a portion of the investment returns from the premium is paid monthly as an annuity. When the policyholder dies or the term matures, the principal of the paid premium is returned. Complaints arose because the annuity amount did not meet the minimum guaranteed interest rate. The issue centers on the fact that insurance companies deducted funds for maturity payments and calculated the monthly annuity amount but did not properly explain this to policyholders.

Consumers also won in a lawsuit regarding automobile insurance deductibles. The Seoul Central District Court ruled in favor of the plaintiffs, who filed a lawsuit against the National Federation of Private Taxi Transport Associations seeking compensation for automobile insurance deductibles.

In November 2020, the Korea Financial Consumer Federation filed a class-action lawsuit with about 100 consumers against 10 non-life insurers, rental car associations, and bus and taxi mutual aid associations, demanding the return of unpaid deductibles.

The deductible system requires policyholders to pay a portion of their own vehicle repair costs, ranging from 200,000 to 500,000 KRW, before fault determination in car-to-car accidents. However, controversy arose because insurance companies did not refund the deductible to the contract holders even after recovering subrogation payments from the opposing insurer based on fault determination results.

Financial authorities and non-life insurers argue that deductibles are intended to prevent moral hazard caused by excessive repairs and therefore cannot be refunded. Although a class-action lawsuit against non-life insurers has not yet been filed, this recent ruling has emerged as a significant variable.

An industry official said, "Although the court ruled in favor of consumers in the deductible lawsuit, judgments on individual cases may differ. The industry atmosphere is that legal rulings are necessary to resolve the controversy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.