Final Inspection of Samsung Electronics Semiconductor... Diversification and Localization of Testing Equipment Accelerate

Supplying Burn-in Testers Worth 10.7 Billion KRW... SSD Equipment Also Plays a Key Role

20% of Sales Invested in R&D... New Products to Launch One After Another Starting Next Year

The next-generation burn-in tester 'i2154' developed by Exicon. The company recently signed a supply contract for burn-in testers worth 10.7 billion KRW with Samsung Electronics.

The next-generation burn-in tester 'i2154' developed by Exicon. The company recently signed a supply contract for burn-in testers worth 10.7 billion KRW with Samsung Electronics. [Photo by Exicon]

[Asia Economy Reporter Junhyung Lee] "Research and development is the lifeblood of the semiconductor back-end process field. Since the technology lifespan is only about 3 to 5 years, we must devote ourselves to R&D to avoid being left behind in the market."

Exicon is a company that develops and manufactures quality inspection equipment for memory semiconductors. Exicon's inspection equipment is used in the final stages of the back-end process of memory semiconductors. Since the inspection equipment detects semiconductor defects in advance, it plays a crucial role in ensuring product reliability. Samsung Electronics has been the main client since the early development of the inspection equipment. Exicon essentially performs the final quality inspection of semiconductors produced by Samsung Electronics.

Accelerating Diversification of Inspection Equipment... Enhancing Semiconductor Competitiveness through Localization

The company has been accelerating its research and development efforts since last year. This is to diversify the portfolio of inspection equipment, which was previously limited to the memory semiconductor field. The development of non-memory (SoC) inspection equipment is in its final stages, and burn-in inspection equipment is about to enter mass production. In particular, the non-memory inspection equipment, which has so far relied solely on foreign products, is said by the company to be the first domestically produced version. Recently, Exicon signed a supply contract worth 10.7 billion KRW for burn-in inspection equipment with Samsung Electronics. CEO Sangjun Park explained, "The proportion of R&D expenses relative to sales has averaged 20% over the past three years, reflecting significant investment in securing new technologies," adding, "Once semiconductor inspection equipment is localized, global companies will inevitably lower prices by about 20-30%, enhancing the price competitiveness of manufacturers like Samsung Electronics."

The rapid changes in the semiconductor back-end process industry are why Exicon is focusing on product diversification. The semiconductor manufacturing process is broadly divided into front-end and back-end processes, but industry experts say that semiconductor performance is essentially determined in the back-end stage. Accordingly, back-end process equipment must respond most swiftly to the rapidly changing semiconductor market. While the technology lifespan of front-end equipment is 5 to 10 years, back-end equipment rarely exceeds 5 years.

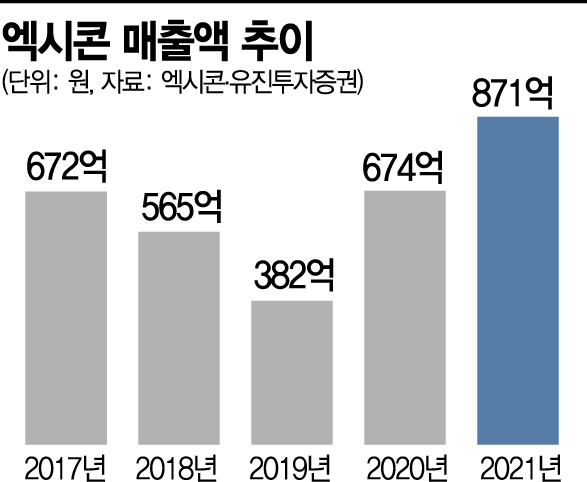

The performance slump experienced several years ago became a catalyst for these efforts. In 2017, the company recorded its highest-ever sales (67.2 billion KRW) as the supply of DDR4 inspection equipment, the 4th generation of DRAM semiconductors, expanded. However, from the following year, as the semiconductor market began shifting to the next-generation DDR5 DRAM and the semiconductor industry downturn overlapped, sales dropped significantly to 56.5 billion KRW and continued to decline thereafter. Nevertheless, Exicon succeeded in rebounding last year thanks to intense R&D that led to the development and mass production of DDR5 inspection equipment. At that time, the company raised its R&D expenditure ratio to about 30% of sales.

SSD Inspection Equipment Also a Cash Cow... Full-Scale Production of New Products

The 4th generation equipment that inspects solid-state drives (SSD, next-generation storage devices based on NAND flash) at ultra-high speed is another R&D achievement. SSD inspection equipment accounts for about 40% of total sales, serving as a 'cash cow' product for the company.

With the rapid growth of the internet server market last year due to COVID-19, SSD demand also increased, painting a rosy outlook for the future. According to market research firm IDC, the global SSD market is expected to grow at an average annual rate of 18%, expanding from 24 trillion KRW in 2019 to 55 trillion KRW in 2024. CEO Park said, "The SSD market is currently transitioning from the 4th to the 5th generation," adding, "We have completed the development of 5th generation inspection equipment and are currently conducting product verification."

CEO Park expressed confidence in a 'quantum jump.' This is because a semiconductor supercycle (long-term boom) is expected starting this year, and new product lines will be launched one after another from the first half of next year. The CIS (CMOS Image Sensor) inspection equipment, developed jointly with Samsung Electronics since early last year, is expected to enter mass production as early as the fourth quarter of this year. CIS inspection equipment was one of the semiconductor devices heavily dependent on imports from Japan. CEO Park stated, "From next year, we will fully ramp up production of newly developed products such as MBT (Memory Burn-in Tester)," adding, "Since the CIS inspection equipment was jointly developed with Samsung Electronics through a national project, sales visibility is expected to improve rapidly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)