Three On-to-Loan Companies' Loan Balances Total 223.2 Billion KRW Last Month

Down 53.4 Billion KRW (19.3%) from 276.6 Billion KRW at the Start of the Year

On-to-Loan Industry Says "Soft Landing Period Needed Initially"

[Asia Economy Reporter Song Seung-seop] The online investment-linked finance (P2P) industry is struggling to gain momentum. Despite receiving official approval from financial authorities, it has failed to achieve notable results or performance. Although it claims to be innovative finance, it has yet to establish itself as an attractive option for consumers.

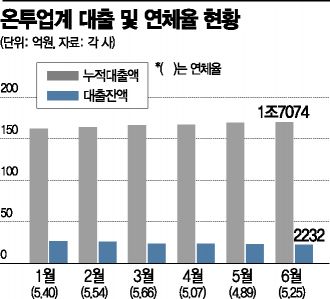

According to the industry on the 12th, the loan balance of three online investment companies?8 Percent, Rendit, and PeopleFund?last month was 223.2 billion KRW. This is a decrease of 9.3 billion KRW from the previous month’s 232.5 billion KRW. Compared to the loan balance of 276.6 billion KRW in January, it has decreased by 53.4 billion KRW (19.3%). Except for a single increase of 4 billion KRW by 8 Percent in May, all companies have recorded a monthly decline since the beginning of this year.

These companies are financial firms that first settled into the regulatory framework after the implementation of the Online Investment-Linked Finance Act (OnTu Act) on August 27 last year. The OnTu Act stipulates that to operate a P2P business, companies must meet various requirements and formally register with financial authorities by the end of August. Although they received official approval from the Financial Services Commission about a month ago on the 10th of last month, the loan balance has actually shrunk.

Cumulative Loan Amount Also at Lowest... Industry Says "Soft Landing Period Needed"

The increase in cumulative loan amounts also recorded the lowest level this year. Last month, the cumulative loan amount in the OnTu industry was 17.0074 trillion KRW, increasing by only 13.3 billion KRW. Compared to the previous month’s increase of 15.6 billion KRW, this is a decrease of 2.3 billion KRW. Compared to the first quarter, when the amount increased by 16 to 18 billion KRW monthly, the decline is even more pronounced.

The delinquency rate rose to 5.25%, up 0.36 percentage points from 4.89% before approval. However, this is a slight decrease compared to the peak of 5.66% earlier this year.

This contrasts sharply with internet-only banks, which have shown explosive growth from the start by promoting "24-hour innovative finance without branches." K Bank, launched in January 2017 as the first internet bank, quickly secured customers with about 250,000 people in one month, faster than traditional banks. KakaoBank, launched in July of the same year, surpassed the total number of non-face-to-face account openings of all commercial banks (155,000 accounts) within 11 hours on its first day. The loan amount achieved in 30 days reached 1.409 trillion KRW.

Industry insiders explain that a "soft landing" period is necessary. Given the many stringent regulations, it inevitably takes time to conduct aggressive marketing. An industry official said, "There was also an impact from temporarily suspending loan and investment operations while preparing the new OnTu system," adding, "We expect rapid growth to begin in the second half of the year through investment attraction and other efforts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.